stochastic programming

Stochastic optimal day-ahead bid with physical future contracts

Tue, 06/10/2008 - 12:12 — admin| Publication Type | Conference Paper |

| Year of Publication | 2008 |

| Authors | Cristina Corchero; F.-Javier Heredia |

| Conference Name | International Workshop on Operational Research 2008 |

| Series Title | I.W.OR. International Workshop on Operations Research |

| Pagination | 77 |

| Conference Date | 05-07/06/2008 |

| Publisher | Dept. of Statistics and Operational Research, Univ. Rey Juan Carlos. |

| Conference Location | Dept. of Statistics and Operational Research, Univ. Rey Juan Carlos, Madrid, Spain. |

| Type of Work | Invited presentation |

| ISBN Number | 978-84-691-3994-3 |

| Key Words | stochastic programming; electricity markets; day-ahead market; futures contracts; MIBEL; modellization; research |

| Abstract |

The reorganization of electricity industry in Spain has finished a new step with the start-up of the Derivatives Market. Nowadays all electricity transactions in Spain and Portugal are managed jointly through the MIBEL by the Day-Ahead Market Operator and the Derivatives Market Operator. This new framework requires important changes in the short-term optimization strategies of the Generation Companies.

One main characteristic of MIBEL’s derivative market is the existence of short-term physical futures contracts; they imply the obligation to settle physically the energy. The regulation of our market establishes the mechanism for including those physical futures in the day-ahead bidding of the Generation Companies. Thus, the participation in the derivatives market changes the incomes function. The goal of this work is the optimization of the coordination between the physical products and the day-ahead bidding following this regulation because it could imply changes in the optimal planning, both in the optimal bidding and in the unit commitment.

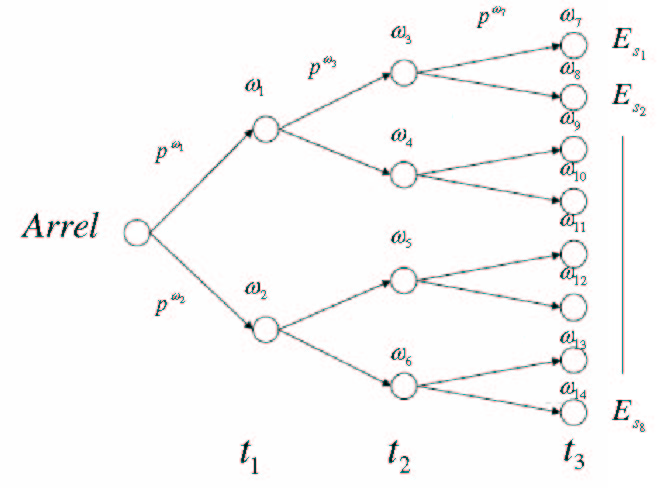

We propose a stochastic mixed-integer programming model to coordinate the Day-Ahead Market and the physical futures contracts of the generation company. The model maximizes the expected profits taking into account futures contracts incomes. The model gives the optimal bidding strategy for the Day-Ahead Market as long as the simultaneous optimization for power planning production and day-ahead market bidding for the thermal units of a price-taker generation company. Thus, the model gives the optimal bid, particularly the instrumental-price bid quantity and its economic dispatch, and it provides the unit commitment. The uncertainty of the day-ahead market price is included in the stochastic model through a scenario tree. There has been applied both reduction and generation techniques for building this scenario tree from an ARIMA model. Results applying those different approaches are presented. The implementation is done with a modelling language. Implementation details and some first computational experiences for small real cases are presented. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Stochastic programming model for the day-ahead bid and bilateral contracts settlement problem

Tue, 06/10/2008 - 11:57 — admin| Publication Type | Conference Paper |

| Year of Publication | 2008 |

| Authors | F.-Javier Heredia; Marcos-J. Rider; Cristina Corchero |

| Conference Name | International Workshop on Operational Research 2008 |

| Series Title | I.W.OR. International Workshop on Operations Research |

| Pagination | 79 |

| Conference Date | 5-7/06/2008 |

| Publisher | Dept. of Statistics and Operational Research, Univ. Rey Juan Carlos. |

| Conference Location | Dept. of Statistics and Operational Research, Univ. Rey Juan Carlos, Madrid, Spain |

| Type of Work | Invited presentation |

| ISBN Number | 978-84-691-3994-3 |

| Key Words | stochastic programming; electricity markets; day-ahead market; bilateral contracts; Virtual Power Plant; Generic Programming Unit; MIBEL; modellization; research |

| Abstract | The new rules of electrical energy production market operation of the Spanish peninsular system (MIBEL) from the July 2007, bring new challenges in the modeling and solution of the production market operation. In order to increase the proportion of electricity that is purchased through bilateral contracts and to stimulate liquidity in forward electricity markets, the MIBEL rules imposes to the dominant utility companies in the Spanish peninsular Markets to hold a series of auctions offering virtual power plant (VPP) capacity to any party who is a member of the Spanish peninsular electricity market. In Spain, the VPP capacity means that the buyer of this product will have the capacity to generate MWh at his disposal. The energy resulting from the exercise of the VPP options can be used by buyers in several ways: covering national and international bilateral contracts prior to the day-ahead market; bidding to the day-ahead market and covering national bilateral contracts after the day-ahead market. This work develops a stochastic programming model that integrates the most recent regulation rules of the Spanish peninsular system for bilateral contracts, especially VPP auctions, in the day-ahead optimal bid problem. The model currently developed allows a price-taker generation company to decide the unit commitment of the thermal units, the economic dispatch of the bilateral contracts between the thermal and generic units and the optimal bid observing the Spanish peninsular regulation. The scenario tree representing the uncertainty of the spot prices is built applying reduction techniques to the tree obtained from an ARIMA model. The model was solved with real data of a Spanish generation company and market prices. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Coordinación hidrotérmica a corto y largo plazo de la generación eléctrica en un mercado competitivo (DPI2002-03330).

Wed, 10/24/2007 - 23:53 — admin| Publication Type | Funded research projects |

| Year of Publication | 2002 |

| Authors | F.-Javier Heredia |

| Type of participation | Full time researcher |

| Duration | 01/2003 -12/2005 |

| Funding organization | Ministerio de Educación y Ciencia |

| Partners | Departament d'Estadística i Investigació Operativa / Universitat Politècnica de Catalunya; Unión Fenosa |

| Full time researchers | 7 |

| Budget | 85.000’00 € |

| Project code | DPI2002-03330 |

| Key Words | research; dual methods; lagrangian relaxation; unit commitment; power systems; transmission network; radar multiplier; project; public; competitive; micinn; energy |

| Export | Tagged XML BibTex |

Planificación de la generación eléctrica a corto y largo plazo en un mercado liberalizado con contratos bilaterales (DPI2005-09117-C02-01).

Wed, 10/24/2007 - 23:39 — admin| Publication Type | Funded research projects |

| Year of Publication | 2005 |

| Authors | F.-Javier Heredia |

| Type of participation | Full time researcher |

| Duration | 01/2006-12/2008 |

| Funding organization | Ministerio de Educación y Ciencia |

| Partners | Departament d'Estadística i Investigació Operativa, Universidad Politèctica de Catalunya; Unión Fenosa |

| Full time researchers | 5 |

| Budget | 289.408'00€ |

| Project code | DPI2005-09117-C02-01 |

| Key Words | research; stochastic programming; electricity markets; future contracts; bilateral contracts; regulation markets; project; public; competitive; micinn; energy |

| Abstract | The project aims at two new features: the simultaneous consideration of bidding power to the liberalized market and of bilateral contracts (between a generation company and a consumer client), given the future elimination of the current regulations discouraging bilateral contracts, and the developement of optimization procedures more efficient than those employed now to solve these problems. This higher efficiency will allow a more accurate modeling and solving larger real problems in reasonable CPU time. In this project, both modeling languages and commercially available solvers in the one hand, and our own optimization algorithms in the other are employed. The algorithms to be developed include the use of: interior-point methods, global optimization, column-generation methods, and Lagrangian relaxation procedures employing dual methods |

| URL | Click Here |

| Export | Tagged XML BibTex |

Reducció d'escenaris per a l'optimització de l'oferta del mercat elèctric

Wed, 10/24/2007 - 22:49 — admin| Publication Type | Tesis de Grau i Màster // BSc and MSc Thesis |

| Year of Publication | 2007 |

| Authors | Albert Roso Llorach |

| Director | Heredia, F.J.; Corchero, C. |

| Tipus de tesi | Tesi de Grau |

| Titulació | Diplomatura d'Estadística |

| Centre | Facultat de Matemàtiques i Estadística, UPC |

| Data defensa | 26/09/2007 |

| Key Words | stochastic programming; scenario reduction; power systems; AMPL; electricity markets; teaching |

| Abstract | El Projecte Fi de Carrera presentat tracta sobre la construcció d’arbres d’escenaris i la seva aplicació en problemes de Programació Estocàstica. Un arbre d’escenaris constitueix una representació discreta del conjunt de possibles estats futurs d’un procés estocàstic, per exemple, la càrrega elèctrica, el preu de l’electricitat, el preu del fuel, etc. Normalment els arbres generats contenen un nombre d’escenaris massa gran, fet que comporta una costosa i poc eficient resolució dels models d’optimització on són utilitzats. Per tal d’aconseguir una eficient resolució, duem a terme una aproximació de l’arbre original amb un arbre format per un nombre més reduït d’escenaris. Per tal de poder realitzar aquesta reducció s’han implementat dos tipus d’algorismes de reducció d’escenaris descrits en l’article de Gröwe-Kuska, Heitsch i Römisch [10]: - Simultaneous Backward Reduction - Fast Forward Selection Es tracta de dos algorismes heurístics de reducció que determinen un subconjunt del conjunt d’escenaris inicials i assignen noves probabilitats als escenaris conservats. La metodologia de Simultaneous Backward Reduction es basa en l’eliminació d’escenaris fins a que resten el nombre desitjat d’escenaris conservats. Mentre que en el cas de Fast Forward Selection es fonamenta en la selecció d’escenaris fins a obtenir el nombre desitjat d’escenaris preservats. Aquests dos algorismes han estat implementats en el llenguatge de modelització matemàtica AMPL. Els nous arbres reduïts, seran utilitzats en la resolució d’un problema d’optimització de l’oferta al mercat elèctric diari. |

| Export | Tagged XML BibTex |

Generació d'escenaris per a l'optimització de l'oferta al mercat elèctric

Wed, 10/24/2007 - 22:45 — admin| Publication Type | Tesis de Grau i Màster // BSc and MSc Thesis |

| Year of Publication | 2007 |

| Authors | Elisenda Vila Jofre |

| Director | Heredia, F.J.; Corchero, C. |

| Tipus de tesi | Tesi de Grau |

| Titulació | Diplomatura d'Estadística |

| Centre | Facultat de Matemàtiques i Estadística, UPC |

| Data defensa | 26/09/2007 |

| Key Words | stochastic programming; scenario generation; power systems; AMPL; electricity markets; teaching |

| Abstract | El sector elèctric espanyol ha passat en els darrers anys de tenir una estructura de preus regulada per el govern a una estructura de mercat on els preus de l’energia es marquen en funció de l’oferta i la demanda. Aquest nou entorn canvia els problemes als quals s’enfronta una companyia generadora, ja que desconeix el preu al que li pagaran la producció i la producció final. Per a poder introduir aquesta informació en els models d’optimització necessitem representar la incertesa de manera que sigui apropiada per a la seva computació. És en aquest punt on neix la necessitat de construir els arbres d’escenaris. Al llarg d’aquest projecte es detallen els procediments seguits per tal de construir els arbres d’escenaris i se’n descriu una possible aplicació en un model d’optimització. |

| Export | Tagged XML BibTex |

Optimal Short-Term Strategies for a Generation Company in the MIBEL

Mon, 09/24/2007 - 18:29 — admin| Publication Type | Conference Paper |

| Year of Publication | 2006 |

| Authors | Corchero, C.; Heredia, F. J. |

| Conference Name | APMOD 2006: Applied Mathematical Programming and Modellization |

| Conference Date | 19-21/06/06 |

| Conference Location | Madrid |

| Editor | Universidad Rey Juan carlos, Universidad Pontificia de Comillas |

| Type of Work | Contributed session |

| Key Words | stochastic programming; electricity markets; day-ahead market; future contracts; research |

| Abstract | MIBEL, the future Spanish and Portuguese electricity market, is expected to start in 2007 and one of the most important changes will be the creation of short-term futures markets, such as daily and weekly futures contracts. This new framework will require important changes in the short term optimization strategies of the generation companies. We propose a methodology to coordinate the day-ahead market and the new daily futures market proposed in the MIBEL. This coordination is particularly important in physical futures contracts; they imply the obligation to supply energy and could change the optimal power planning. The methodology is based on stochastic mixed-integer programming and gives the optimal bid in the futures markets as long as the simultaneous optimization for power planning production and day-ahead market bidding for the thermal units of a price-taker generation company. The approach presented is stochastic because of the uncertainty of the spot and futures market prices. We use time series techniques to model the market prices and we introduce them in the optimization model by an optimally generated scenario tree. The implementation is done with a modelling language. Implementation details and some first computational experiences for small cases are presented. |

| URL | Click Here |

| Export | Tagged XML BibTex |

A mixed-integer stochastic programming model for the day-ahead and futures energy markets coordination

Sat, 09/22/2007 - 12:55 — admin| Publication Type | Conference Paper |

| Year of Publication | 2007 |

| Authors | Corchero, C.; Heredia, F. J. |

| Conference Name | EURO XXII: 2nd European Conference on Operational Reserach |

| Conference Date | 08/07/2007 |

| Publisher | The Association of European Operational Research Societies |

| Conference Location | Prague, Czech Republic |

| Type of Work | Oral presentacion |

| Key Words | stochastic programming; electricity markets; day-ahead market; future contracts; research |

| Abstract | The participation in spot-market and in financial markets has traditionally been studied independently but there are some evidences that indicate it could be interesting a joint approach. We propose a methodology based on stochastic mixed-integer programming to coordinate the day-ahead market and the physical futures contracts. It gives the optimal bid for the spot-market as long as the simultaneous optimization for power planning production and day-ahead market bidding for the thermal units of a price-taker generation company. Implementation details and some first computational experiences for small real cases are presented. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Lectura de dos PFC's a la DE sobre generació/reducció d'escenaris en mercats elèctrics

Sat, 09/22/2007 - 11:57 — admin

Dimecres 26 de setembre, a l'aula 102 de l'FME, a les 12h, es defensaren dos projectes de la DE sobre generació i reducció d'escenaris per a problemes d'optimització en mercats elèctrics, elaborats pels alumnes Elisenda Vila i Albert Roso. Han estat codirigits per la Cristina Corchero i en Javier Heredia.

Dimecres 26 de setembre, a l'aula 102 de l'FME, a les 12h, es defensaren dos projectes de la DE sobre generació i reducció d'escenaris per a problemes d'optimització en mercats elèctrics, elaborats pels alumnes Elisenda Vila i Albert Roso. Han estat codirigits per la Cristina Corchero i en Javier Heredia.