electricity market

New research project granted by the "Ministerio de Ciencia e Innovación"

Fri, 11/07/2008 - 20:28 — admin  The GNOM research group of the UPC has been granted by the Ministerio de Ciencia e Innovación of the Spanish Government to develop the research project Short - and Medium Term Multimarket Optimal Electricity Generation Planning With Risk and Environmental Constraints. This is a three years project starting on january 2009 with an assigned budget of 130.000€, that extens the work done in several previous research projects . The leader of the project is Prof. F. Javier Heredia, and participate several researchers from the Universidad Politècnica de Catalunya, Universidad del País Vasco, Universidade Estadual de Campinas-UNICAMP, University of Edinburgh and Norwegian University of Science and Technology.The spanish electrical utilities Unión Fenosa and Gas Natural are also involved in the project as external observers and promoters. Follow this link to know more about this project.

The GNOM research group of the UPC has been granted by the Ministerio de Ciencia e Innovación of the Spanish Government to develop the research project Short - and Medium Term Multimarket Optimal Electricity Generation Planning With Risk and Environmental Constraints. This is a three years project starting on january 2009 with an assigned budget of 130.000€, that extens the work done in several previous research projects . The leader of the project is Prof. F. Javier Heredia, and participate several researchers from the Universidad Politècnica de Catalunya, Universidad del País Vasco, Universidade Estadual de Campinas-UNICAMP, University of Edinburgh and Norwegian University of Science and Technology.The spanish electrical utilities Unión Fenosa and Gas Natural are also involved in the project as external observers and promoters. Follow this link to know more about this project.

Short- and Medium-Term Multimarket Optimal Electricity Generation Planning with Risk and Environmental Constraints (DPI2008-02153)

Fri, 11/07/2008 - 19:57 — admin| Publication Type | Funded research projects |

| Year of Publication | 2008 |

| Authors | F.-Javier Heredia |

| Type of participation | Project leader |

| Duration | 01/2009-12/2011 |

| Call | Proyectos de Investigación Fundamental no Orientada 2008. IV Plan Nacional de I+D+i (2008-2011) |

| Funding organization | Ministerio de Ciencia e Innovación, Gobierno de España |

| Partners | Unión Fenosa, Gas Natural, Universidad Politècnica de Catalunya, Universidad del País Vasco, Universidade Estadual de Campinas-UNICAMP, University of Edinburgh, Norwegian University of Science and Technology. |

| Full time researchers | 6 EDP |

| Budget | 157.300'00€ |

| Project code | DPI2008-02153 |

| Key Words | research; stochastic programming; electricity markets; risc; multimarket; environmental constraints; project; public; competitive; micinn; energy |

| URL | Click Here |

| Export | Tagged XML BibTex |

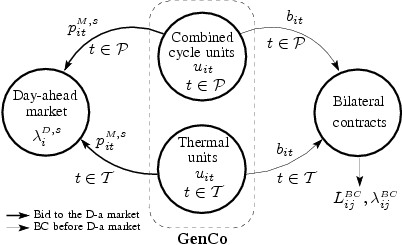

A stochastic programming model for the optimal electricity market bid problem with bilateral contracts for thermal and CC units

Thu, 10/09/2008 - 17:48 — admin

This work, co-authored by Dr. Marcos.-J Rider and Ms. Cristina Corchero and submitted to the journal Annals of Operations Research, developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the day-ahead optimal bid problem. This model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the bilateral contracts between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. See the full text at http://hdl.handle.net/2117/2282

A stochastic programming model for the optimal electricity market bid problem with bilateral contracts for thermal and combined cycle units

Thu, 10/09/2008 - 17:27 — admin| Publication Type | Report |

| Year of Publication | 2008 |

| Authors | Heredia, F.-Javier, Rider, Marcos.-J., Corchero, C. |

| Pages | 18 |

| Date | 10/2008 |

| Reference | Group on Numerical Optimization and Modelling, E-Prints UPC, http://hdl.handle.net/2117/2282. UPC. |

| Prepared for | Accepted for publication in Annals of Operations Research (2011) |

| City | Barcelona |

| Key Words | combined cycle units; optimal bid; bilateral contracts; day-ahead market; electricity markets; stochastic programming; modeling language; research |

| Abstract | This paper developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the day-ahead optimal bid problem. Our model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the BC between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. The model was solved using real data of a typical generation company and a set of scenarios for the Spanish market price. The results are reported and analyzed. |

| URL | Click Here |

| Export | Tagged XML BibTex |

A decision support procedure for a Price-Taker producer operating on Day-Ahead and Physical Derivatives Electricity Markets

Fri, 07/11/2008 - 18:28 — admin| Publication Type | Conference Paper |

| Year of Publication | 2008 |

| Authors | Cristina Corchero; F-Javier Heredia; M-Teresa Vespucci; Mario Innorta |

| Conference Name | V International Summer School in Risk Measurement and Control |

| Conference Date | 30/06-04/07/2008 |

| Publisher | Luiss Guido Carli University |

| Conference Location | Roma |

| Type of Work | Contributed oral presentation |

| Key Words | future contracts; electricity markets; stochastic programming; research |

| URL | Click Here |

| Export | Tagged XML BibTex |

Optimal thermal and virtual power plants operation in the day-ahead electricity market.

Tue, 06/10/2008 - 12:22 — admin| Publication Type | Conference Paper |

| Year of Publication | 2008 |

| Authors | F.-Javier Heredia; Marcos-J. Rider; Cristina Corchero |

| Conference Name | APMOD 2008 International Conference on Applied Mathematical Programming and Modelling |

| Series Title | APMOD2008 CONFERENCE BOOK |

| Pagination | 21 |

| Conference Date | 27-30/05/2008 |

| Conference Location | Comenius University, Bratislava, Slovak Republic |

| Type of Work | Contributed presentation |

| Key Words | stochastic programming; electricity markets; day-ahead market; bilateral contracts; Virtual Power Plant; Generic Programming Unit; MIBEL; modellization; research |

| Abstract | The new rules of the electrical energy production market operation of the Iberic Electricity Market MIBEL (mainland Spanish and Portuguese systems), for the diary and intra-diary market (July 2007), bring new challenges in the modeling and solution of the production market operation. Aiming to increase the proportion of electricity that is purchased through bilateral contracts with duration of several months and intending to stimulate liquidity in forward electricity markets, the Royal Decree 1634/2006, dated December 29th, 2006 imposes to Endesa and Iberdrola (the two dominant utility companies in the Spanish peninsular Markets) to hold a series of five auctions offering virtual power plant (VPP) capacity to any party who is a member of the MIBEL. Other experience of the application of VPP auctions can be seen in France, Belgium and Germany. In Spain, the VPP capacity means that the buyer of this product will have the capacity to generate MWh at his disposal. The buyer can exercise the right to produce against an exercise price that is set in advance, by paying an option premium. So although Endesa and Iberdrola still own the power plants, part of their capacity to produce will be at the disposal of the buyers of VPP. VPP capacity is represented by a set of hourly call options giving the buyer the right to nominate energy for delivery at a pre-defined exercise price. There will be baseload and peakload contracts with different exercise prices. The energy resulting from the exercise of the VPP options can be used by buyers in several ways: (a) national and international bilateral contracts prior to the day-ahead market; (b) bids to the day-ahead market and (c) national bilateral contracts after the day-ahead market. In order to operate the VPP options each buyer agent will have a Generic Unit (GU). This work develops an stochastic programming model for a Generation Company (GenCo) to find the optimal management of a VPP in the day-ahead electricity market under the most recent bilateral contracts regulation rules of MIBEL energy market. |

| Export | Tagged XML BibTex |

Stochastic optimal day-ahead bid with physical future contracts

Tue, 06/10/2008 - 12:12 — admin| Publication Type | Conference Paper |

| Year of Publication | 2008 |

| Authors | Cristina Corchero; F.-Javier Heredia |

| Conference Name | International Workshop on Operational Research 2008 |

| Series Title | I.W.OR. International Workshop on Operations Research |

| Pagination | 77 |

| Conference Date | 05-07/06/2008 |

| Publisher | Dept. of Statistics and Operational Research, Univ. Rey Juan Carlos. |

| Conference Location | Dept. of Statistics and Operational Research, Univ. Rey Juan Carlos, Madrid, Spain. |

| Type of Work | Invited presentation |

| ISBN Number | 978-84-691-3994-3 |

| Key Words | stochastic programming; electricity markets; day-ahead market; futures contracts; MIBEL; modellization; research |

| Abstract |

The reorganization of electricity industry in Spain has finished a new step with the start-up of the Derivatives Market. Nowadays all electricity transactions in Spain and Portugal are managed jointly through the MIBEL by the Day-Ahead Market Operator and the Derivatives Market Operator. This new framework requires important changes in the short-term optimization strategies of the Generation Companies.

One main characteristic of MIBEL’s derivative market is the existence of short-term physical futures contracts; they imply the obligation to settle physically the energy. The regulation of our market establishes the mechanism for including those physical futures in the day-ahead bidding of the Generation Companies. Thus, the participation in the derivatives market changes the incomes function. The goal of this work is the optimization of the coordination between the physical products and the day-ahead bidding following this regulation because it could imply changes in the optimal planning, both in the optimal bidding and in the unit commitment.

We propose a stochastic mixed-integer programming model to coordinate the Day-Ahead Market and the physical futures contracts of the generation company. The model maximizes the expected profits taking into account futures contracts incomes. The model gives the optimal bidding strategy for the Day-Ahead Market as long as the simultaneous optimization for power planning production and day-ahead market bidding for the thermal units of a price-taker generation company. Thus, the model gives the optimal bid, particularly the instrumental-price bid quantity and its economic dispatch, and it provides the unit commitment. The uncertainty of the day-ahead market price is included in the stochastic model through a scenario tree. There has been applied both reduction and generation techniques for building this scenario tree from an ARIMA model. Results applying those different approaches are presented. The implementation is done with a modelling language. Implementation details and some first computational experiences for small real cases are presented. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Stochastic programming model for the day-ahead bid and bilateral contracts settlement problem

Tue, 06/10/2008 - 11:57 — admin| Publication Type | Conference Paper |

| Year of Publication | 2008 |

| Authors | F.-Javier Heredia; Marcos-J. Rider; Cristina Corchero |

| Conference Name | International Workshop on Operational Research 2008 |

| Series Title | I.W.OR. International Workshop on Operations Research |

| Pagination | 79 |

| Conference Date | 5-7/06/2008 |

| Publisher | Dept. of Statistics and Operational Research, Univ. Rey Juan Carlos. |

| Conference Location | Dept. of Statistics and Operational Research, Univ. Rey Juan Carlos, Madrid, Spain |

| Type of Work | Invited presentation |

| ISBN Number | 978-84-691-3994-3 |

| Key Words | stochastic programming; electricity markets; day-ahead market; bilateral contracts; Virtual Power Plant; Generic Programming Unit; MIBEL; modellization; research |

| Abstract | The new rules of electrical energy production market operation of the Spanish peninsular system (MIBEL) from the July 2007, bring new challenges in the modeling and solution of the production market operation. In order to increase the proportion of electricity that is purchased through bilateral contracts and to stimulate liquidity in forward electricity markets, the MIBEL rules imposes to the dominant utility companies in the Spanish peninsular Markets to hold a series of auctions offering virtual power plant (VPP) capacity to any party who is a member of the Spanish peninsular electricity market. In Spain, the VPP capacity means that the buyer of this product will have the capacity to generate MWh at his disposal. The energy resulting from the exercise of the VPP options can be used by buyers in several ways: covering national and international bilateral contracts prior to the day-ahead market; bidding to the day-ahead market and covering national bilateral contracts after the day-ahead market. This work develops a stochastic programming model that integrates the most recent regulation rules of the Spanish peninsular system for bilateral contracts, especially VPP auctions, in the day-ahead optimal bid problem. The model currently developed allows a price-taker generation company to decide the unit commitment of the thermal units, the economic dispatch of the bilateral contracts between the thermal and generic units and the optimal bid observing the Spanish peninsular regulation. The scenario tree representing the uncertainty of the spot prices is built applying reduction techniques to the tree obtained from an ARIMA model. The model was solved with real data of a Spanish generation company and market prices. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Oferta de treball modelització i optimització de mercats elèctrics

Wed, 04/16/2008 - 13:52 — admin

El Grup d'Optimització Numèrica i Modelització (GNOM) del Departament d'Estadística I Investigació Operativa,

UPC, convoca dues places de tècnic de suport a la recerca. Els candidats seleccionats s'incorporaran al grup de recerca GNOM realitzant tasques de suport a la recerca en modelització i optimització de mercats elèctrics dins del marc del projecte de recerca del Ministerio de Educación y Ciencia (DPI2005-09117-C02-01), en col·laboració amb empreses del sector elèctric espanyol i sota la supervisió dels professors Narcís Nabona i F. Javier Heredia.