modeling languages

Optimal Day-Ahead Bidding in the MIBEL's Multimarket Energy Production System

Mon, 06/28/2010 - 15:17 — admin| Publication Type | Conference Paper |

| Year of Publication | 2010 |

| Authors | Cristina Corchero; F.-Javier Heredia |

| Conference Name | 7th Conference on European Energy Market EEM10 |

| Conference Date | 23-25/06/2010 |

| Conference Location | Madrid, Spain |

| Type of Work | Contributed Presentation |

| Key Words | research; multimarket; bilateral contracts; futures contracts; optimal bid; stochastic programming; MIBEL |

| Abstract | Abstract—A Generation Company (GenCo) can participate in the Iberian Electricity Market (MIBEL) through different mechanisms and pools: the bilateral contracts, the physical derivatives products at the Derivatives Market, the bids to the Day-Ahead Market, the Intraday Markets or the Ancillary Services Markets. From the short-term generation planning point of view, the most important problem to solve is the bidding strategy for the Day-Ahead Market (DAM) given that the 85% of the physical energy traded in Spain is negotiated in it, but this participation cannot be tackled independently of other subsequent markets. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Optimal Bidding Strategies for Thermal and Combined Cycle Units in the Day-ahead Electricity Market with Bilateral Contracts

Fri, 05/28/2010 - 09:58 — admin| Publication Type | Proceedings Article |

| Year of Publication | 2009 |

| Authors | Heredia, F.-Javier; Rider, Marcos.-J.; Corchero, C. |

| Conference Name | 2009 Power Engineering Society General Meeting |

| Pagination | 1-6 |

| Conference Start Date | 26/07/2010 |

| Publisher | IEEE |

| Conference Location | Calgary |

| ISSN Number | 1944-9925 |

| ISBN Number | 978-1-4244-4241-6 |

| Key Words | research; Electricity spot-market; bilateral contracts; combined cycle units; optimal bidding strategies; short-term electricity generation planning; stochastic programming; paper |

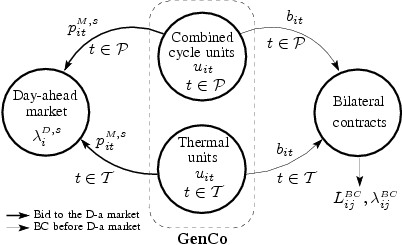

| Abstract | This paper developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the day-ahead optimal bid problem. Our model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the BC between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. The model was solved using real data of a typical generation company and a set of scenarios for the Spanish market price. The results are reported and analyzed. |

| URL | Click Here |

| DOI | 10.1109/PES.2009.5275680 |

| Export | Tagged XML BibTex |

Optimal Bidding Strategies for Thermal and Combined Cycle Units in the Day-ahead Electricity Market with Bilateral Contracts

Tue, 09/08/2009 - 10:28 — admin| Publication Type | Conference Paper |

| Year of Publication | 2009 |

| Authors | Heredia, F.-Javier; Rider, Marcos.-J.; Corchero, C. |

| Conference Name | 2009 Power Engineering Society General Meeting |

| Series Title | Proceedings of the Power Engineering Society General Meeting, 2009. IEEE |

| Volume | 1 |

| Pagination | 1-6 |

| Conference Date | 26-30/07/2009 |

| Publisher | IEEE |

| Conference Location | Calgary, Alberta, Canada |

| Editor | IEEE |

| Type of Work | Contributed oral presentation |

| ISSN Number | 1944-9925 |

| ISBN Number | 978-1-4244-4241-6 |

| Key Words | research; stochastic programming; electricity markets; day-ahead market, bilateral contracts; Combined Cycle Units; optimal bid |

| Abstract | This paper developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the dayahead optimal bid problem. Our model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the BC between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. The model was solved using real data of a typical generation company and a set of scenarios for the Spanish market price. The results are reported and analyzed. |

| URL | Click Here |

| DOI | 10.1109/PES.2009.5275680 |

| Export | Tagged XML BibTex |

Stochastic programming models for optimal bid strategies in the Iberian Electricity Market

Tue, 09/01/2009 - 13:56 — admin| Publication Type | Conference Paper |

| Year of Publication | 2009 |

| Authors | F.-Javier Heredia; Cristina Corchero |

| Conference Name | The 20th International Symposium of Mathematical Programming (ISMP) |

| Conference Date | 23-28/08/2009 |

| Conference Location | Chicago |

| Type of Work | Invited oral presentation |

| Key Words | research; stochastic programming; electricity markets; day-ahead market; bilateral contracts; futures contracts; optimal bid |

| Abstract | The day-ahead market is not only the main physical energy market of Portugal and Spain in terms of the amount of traded energy, but also the mechanism through which other energy products, as bilateral (BC) and physical futures contracts (FC), are integrated into the Iberian Electricity Market (MIBEL) energy production system. We propose stochastic programming models that give the optimal bidding and BC and FC nomination strategy for a price-taker generation company in the MIBEL. Implementation details and some first computational experiences for small real cases are presented. |

| URL | Click Here |

| Export | Tagged XML BibTex |

A stochastic approach to the decision support procedure for a Generation Company operating on Day-Ahead and Physical Derivatives Electricity Market

Wed, 07/22/2009 - 16:46 — admin| Publication Type | Conference Paper |

| Year of Publication | 2009 |

| Authors | Cristina Corchero; M-Teresa Vespucci; F-Javier Heredia; Mario Innorta |

| Conference Name | EURO XXIII: 23rd European Conference on Operational Research |

| Conference Date | 05-08/07/2009 |

| Conference Location | Bonn, Germany |

| Type of Work | Invited oral presentation |

| Key Words | research; electricity markets; day-ahead; futures contracts; hydro-thermal |

| URL | Click Here |

| Export | Tagged XML BibTex |

Oferta òptima multi–mercat al Mercat Ibèric d'Electricitat.

Mon, 03/02/2009 - 18:25 — admin| Publication Type | Tesis de Grau i Màster // BSc and MSc Thesis |

| Year of Publication | 2009 |

| Authors | Eva Romero i Beneyto |

| Director | F.-Javier Heredia |

| Tipus de tesi | Tesi Final de Màster // MSc Thesis |

| Titulació | Màster en Enginyeria Matemàtica |

| Centre | Facultat de Matemàtiques i Estadística, UPC |

| Data defensa | 04/03/2009 |

| Nota // mark | 9 (over 10) E |

| Key Words | teaching; MEM; electricity market; multimarket; optimal offer; stochastic programming; MSc Thesis |

| Abstract | El present projecte analitza, estudia i desenvolupa diversos models multi - mercat estocàstics per al Mercat Ibèric d'Electricitat. A partir de l'artcile "Multimarket Optimal Bidding for a Power Producer" de Plazas et al, s'analitzen i es proposen diverses possibles millores: incorporació de costos quadràtics de generació i una nova definició de funció d'oferta. Aquestes millores es desenvolupen donant lloc un nou model competitiu amb l'anterior. Tenint en compte el reglament de MIBEL, i com a millora al primer proposat, finalment es desenvolupa un tercer model multi – oferta que contempla la definició de la funció d'oferta de forma esglaonada. Els resultats obtinguts mostren com la consideració de la determinació dels graons dins la pròpia modelització és rellevant respecte les funcions d'oferta obtingudes. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Optimal Bidding Strategies for Thermal and Generic Programming Units in the Day-ahead Electricity Market

Fri, 12/19/2008 - 10:57 — admin| Publication Type | Report |

| Year of Publication | 2008 |

| Authors | Heredia, F.-Javier, Rider, Marcos.-J., Corchero, C. |

| Pages | 12 |

| Date | 11/2008 |

| Reference | Research report DR 2008/13, Dept. of Statistics and Operations Research. E-Prints UPC, http://hdl.handle.net/2117/2468. Universitat Politècnica de Catalunya |

| Prepared for | Published on august 2010 at IEEE Transactions on Power Systems |

| Key Words | research; stochastic programming; electricity markets; day-ahead market, bilateral contracts; Virtual Power Plants; optimal bid |

| Abstract | This paper develops a stochastic programming model that integrates the day-ahead optimal bidding problem with the most recent regulation rules of the Iberian Electricity Market (MIBEL) for bilateral contracts, with a special consideration for the new mechanism to balance the competition of the production market, namely virtual power plants auctions (VPP). The model allows a price-taker generation company to decide the unit commitment of the thermal units, the economic dispatch of the bilateral contracts between the thermal units and the generic programming unit (GPU) and the optimal sale/purchase bids for all units (thermal and generic) observing the MIBEL regulation. The uncertainty of the spot prices is represented through scenario sets built from the most recent real data using scenario reduction techniques. The model was solved with real data from a Spanish generation company and spot prices, and the results are reported and analyzed. |

| URL | Click Here |

| Export | Tagged XML BibTex |

A stochastic programming model for the optimal electricity market bid problem with bilateral contracts for thermal and CC units

Thu, 10/09/2008 - 17:48 — admin

This work, co-authored by Dr. Marcos.-J Rider and Ms. Cristina Corchero and submitted to the journal Annals of Operations Research, developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the day-ahead optimal bid problem. This model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the bilateral contracts between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. See the full text at http://hdl.handle.net/2117/2282

A stochastic programming model for the optimal electricity market bid problem with bilateral contracts for thermal and combined cycle units

Thu, 10/09/2008 - 17:27 — admin| Publication Type | Report |

| Year of Publication | 2008 |

| Authors | Heredia, F.-Javier, Rider, Marcos.-J., Corchero, C. |

| Pages | 18 |

| Date | 10/2008 |

| Reference | Group on Numerical Optimization and Modelling, E-Prints UPC, http://hdl.handle.net/2117/2282. UPC. |

| Prepared for | Accepted for publication in Annals of Operations Research (2011) |

| City | Barcelona |

| Key Words | combined cycle units; optimal bid; bilateral contracts; day-ahead market; electricity markets; stochastic programming; modeling language; research |

| Abstract | This paper developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the day-ahead optimal bid problem. Our model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the BC between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. The model was solved using real data of a typical generation company and a set of scenarios for the Spanish market price. The results are reported and analyzed. |

| URL | Click Here |

| Export | Tagged XML BibTex |