day-ahead market

Optimal Bidding Strategies for Thermal and Generic Programming Units in the Day-Ahead Electricity Market

Fri, 03/19/2010 - 16:00 — admin| Publication Type | Journal Article |

| Year of Publication | 2010 |

| Authors | Heredia, F.-J; Rider, M.-Julio; Corchero, C. |

| Journal Title | IEEE Transactions on Power Systems |

| Volume | 25 |

| Issue | 3 |

| Pages | 1504-1518 |

| Start Page | 1504 |

| Journal Date | Aug. 2010 |

| Publisher | IEEE Power & Energy Society |

| ISSN Number | 0885-8950 |

| Key Words | research; paper; bilateral contracts; electricity spot market; optimal bidding strategies; short-term electricity generation planning; stochastic programming; virtual power plant auctions |

| Abstract | This study has developed a stochastic programming model that integrates the day-ahead optimal bidding problem with the most recent regulation rules of the Iberian Electricity Market (MIBEL) for bilateral contracts (BC), with a special consideration for the new mechanism to balance the competition of the production market, namely virtual power plant (VPP) auctions. The model allows a price-taking generation company (GenCo) to decide on the unit commitment of the thermal units, the economic dispatch of the BCs between the thermal units and the generic programming unit (GPU), and the optimal sale/purchase bids for all units (thermal and generic), by observing the MIBEL regulation. The uncertainty of the spot prices has been represented through scenario sets built from the most recent real data using scenario reduction techniques. The model has been solved using real data from a Spanish generation company and spot prices, and the results have been reported and analyzed. |

| URL | Click Here |

| DOI | 10.1109/TPWRS.2009.2038269 |

| Export | Tagged XML BibTex |

A decision support procedure for the short-term scheduling problem of a generation company operating on day-ahead and physical derivatives electricity markets

Mon, 02/15/2010 - 15:42 — admin| Publication Type | Proceedings Article |

| Year of Publication | 2009 |

| Authors | M.-Teresa Vespucci; Cristina Corchero; Mario Innorta; F.-Javier Heredia |

| Conference Name | 11th International Conference on the Modern Information Technology in the Innovation Processes of the Industrial Enterprises (MITIP 2009) |

| Series Title | Proceedings of the 11th International Conference on the Modern Information Technology in the Innovation Processes of the Industrial Enterprises (MITIP 2009) |

| Conference Start Date | 15-16/10/2009 |

| Conference Location | Bergamo, Italy |

| ISBN Number | ISBN 978-88-89555-09-05 |

| Key Words | research; hydro-thermal; futures; day-ahead; GAMS, CPLEX; paper |

| URL | Click Here |

| Export | Tagged XML BibTex |

Optimal Bidding Strategies for Thermal and Combined Cycle Units in the Day-ahead Electricity Market with Bilateral Contracts

Tue, 09/08/2009 - 10:28 — admin| Publication Type | Conference Paper |

| Year of Publication | 2009 |

| Authors | Heredia, F.-Javier; Rider, Marcos.-J.; Corchero, C. |

| Conference Name | 2009 Power Engineering Society General Meeting |

| Series Title | Proceedings of the Power Engineering Society General Meeting, 2009. IEEE |

| Volume | 1 |

| Pagination | 1-6 |

| Conference Date | 26-30/07/2009 |

| Publisher | IEEE |

| Conference Location | Calgary, Alberta, Canada |

| Editor | IEEE |

| Type of Work | Contributed oral presentation |

| ISSN Number | 1944-9925 |

| ISBN Number | 978-1-4244-4241-6 |

| Key Words | research; stochastic programming; electricity markets; day-ahead market, bilateral contracts; Combined Cycle Units; optimal bid |

| Abstract | This paper developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the dayahead optimal bid problem. Our model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the BC between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. The model was solved using real data of a typical generation company and a set of scenarios for the Spanish market price. The results are reported and analyzed. |

| URL | Click Here |

| DOI | 10.1109/PES.2009.5275680 |

| Export | Tagged XML BibTex |

Stochastic programming models for optimal bid strategies in the Iberian Electricity Market

Tue, 09/01/2009 - 13:56 — admin| Publication Type | Conference Paper |

| Year of Publication | 2009 |

| Authors | F.-Javier Heredia; Cristina Corchero |

| Conference Name | The 20th International Symposium of Mathematical Programming (ISMP) |

| Conference Date | 23-28/08/2009 |

| Conference Location | Chicago |

| Type of Work | Invited oral presentation |

| Key Words | research; stochastic programming; electricity markets; day-ahead market; bilateral contracts; futures contracts; optimal bid |

| Abstract | The day-ahead market is not only the main physical energy market of Portugal and Spain in terms of the amount of traded energy, but also the mechanism through which other energy products, as bilateral (BC) and physical futures contracts (FC), are integrated into the Iberian Electricity Market (MIBEL) energy production system. We propose stochastic programming models that give the optimal bidding and BC and FC nomination strategy for a price-taker generation company in the MIBEL. Implementation details and some first computational experiences for small real cases are presented. |

| URL | Click Here |

| Export | Tagged XML BibTex |

A stochastic approach to the decision support procedure for a Generation Company operating on Day-Ahead and Physical Derivatives Electricity Market

Wed, 07/22/2009 - 16:46 — admin| Publication Type | Conference Paper |

| Year of Publication | 2009 |

| Authors | Cristina Corchero; M-Teresa Vespucci; F-Javier Heredia; Mario Innorta |

| Conference Name | EURO XXIII: 23rd European Conference on Operational Research |

| Conference Date | 05-08/07/2009 |

| Conference Location | Bonn, Germany |

| Type of Work | Invited oral presentation |

| Key Words | research; electricity markets; day-ahead; futures contracts; hydro-thermal |

| URL | Click Here |

| Export | Tagged XML BibTex |

Estudi i optimització de l'oferta al Mercat Ibèric d'Electricitat (MIBEL)

Wed, 07/22/2009 - 16:40 — admin| Publication Type | Tesis de Grau i Màster // BSc and MSc Thesis |

| Year of Publication | 2009 |

| Authors | Silvia Nieto; Iván Ruz |

| Director | F.-Javier Heredia |

| Tipus de tesi | Tesi de Grau // BSC Thesis |

| Titulació | Diplomatura d'Estadística |

| Centre | Facultat de Matemàtiques i Estadística, UPC |

| Data defensa | 09/07/2009 |

| Nota // mark | 9.5 (over 10) E |

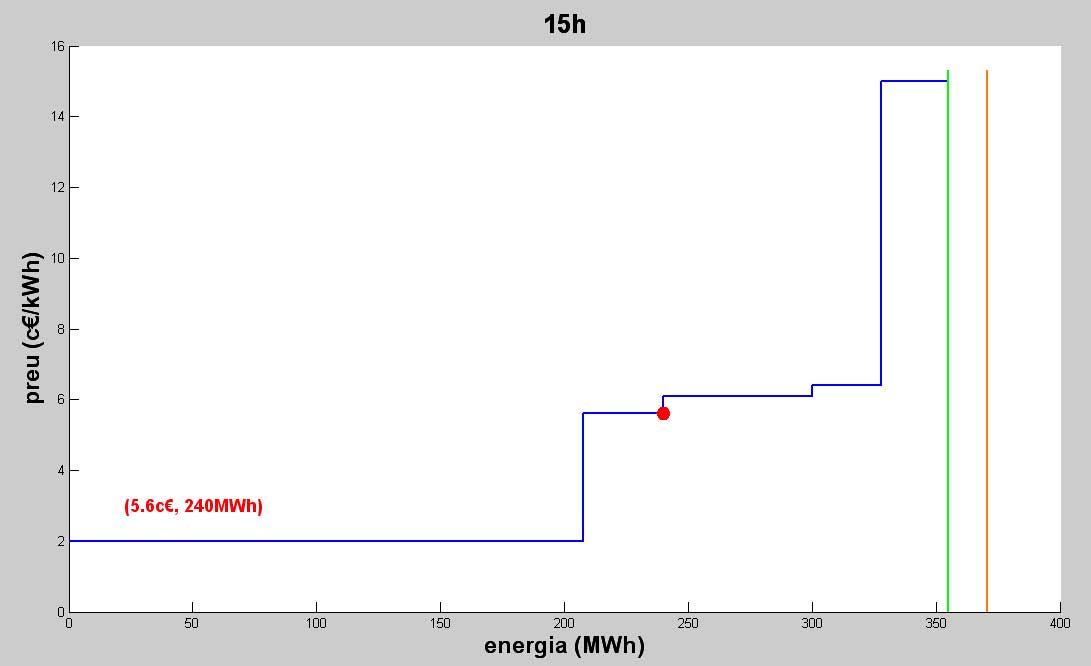

| Key Words | teaching; PFC-DE; MIBEL; optimal bid; BSc Thesis |

| Abstract | Estudi de les ofertes reals de les companyies productores d'energia elèctrica a MIBEL i comparació de dos models alternatius de optimització de l'oferta. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Lectura de dos PFC's a la DE sobre oferta òptima als mercats d'energia elèctrica.

Wed, 07/22/2009 - 16:25 — admin

El passat dijous 9 de juliol de 2009 es va llegir el Projecte Final de Carrera dels alumnes Silvia Nieto i Ivan Ruz, que portava per títol "Estudi i optimització de l’oferta al Mercat Ibèric ’Electricitat (MIBEL)", dirigit pel professor Javier Heredia. Els objectius del treball han estat:

- Fer una descriptiva de les dades obtingudes de les energies tèrmiques per veure el comportament que hi tenen.

- Entendre el model d'optimització d'oferta presentat a l'article [1], i compendre la seva implementació.

- Entendre el model d'optimització d'oferta de l'article [2] i resoldre una nova modelització adaptant aquest model a l'anterior fent els canvis pertinents.

- Comparar els dos models i treure'n conclusions sobre quin és el més eficient.

[1] Arroyo, José M. ; Carrión, Miguel. A computationally efficient mixed-integer linear formulation for the termal unit commitment problem. Institute of Electrical and Electronics Engineers transactions on power systems, vol. 21, nº3, agost 2006.

[2] "A Stochastic Programming Model for the Thermal Optimal Day-Ahead Bid Problem with Physical Futures Contracts", Submitted to European Journal of Operations Research, Barcelona, Espanya, Dept. of Statistics and Operations Research, Universitat Politècnica de Catalunya, 03/2009

A Stochastic Programming Model for the Thermal Optimal Day-Ahead Bid Problem with Physical Futures Contracts

Wed, 03/18/2009 - 17:25 — admin| Publication Type | Report |

| Year of Publication | 2009 |

| Authors | Cristina Corchero; F. Javier Heredia |

| Pages | 19 |

| Date | 03/2009 |

| Reference | Research Report DR 2009/03, Dept. of Statistics and Operations Research, E-Prints UPC http://hdl.handle.net/2117/2795, Universitat Politècnica de Catalunya |

| Prepared for | Accepted for publication at Computers and Operations Research |

| City | Barcelona, Spain. |

| Key Words | research; Stochastic programming; OR in energy; electricity day-ahead market; futures contracts; optimal bid |

| Abstract | The reorganization of the electricity industry in Spain completed a new step with the start-up of the Derivatives Market. One main characteristic of MIBEL’s Derivatives Market is the existence of physical futures contracts; they imply the obligation to settle physically the energy. The market regulation establishes the mechanism for including those physical futures in the day-ahead bidding of the Generation Companies. The goal of this work is to optimize coordination between physical futures contracts and the Day-Ahead bidding which follow this regulation. We propose a stochastic quadratic mixed-integer programming model which maximizes the expected profits, taking into account futures contracts settlement. The model gives the simultaneous optimization for the Day-Ahead Market bidding strategy and power planning production (unit commitment) for the thermal units of a price-taker Generation Company. The uncertainty of the day-ahead market price is included in the stochastic model through a set of scenarios. Implementation details and some first computational experiences for small real cases are presented. |

| URL | Click Here |

| Export | Tagged XML BibTex |

A decision support procedure for the short-term scheduling problem of a Generation Company operating on Day-Ahead and Physical Derivatives Electricity Markets

Thu, 02/12/2009 - 13:04 — admin| Publication Type | Conference Paper |

| Year of Publication | 2008 |

| Authors | Vespucci, M.T.; Corchero, C.; Innorta, M.; Heredia, F.-Javier |

| Conference Name | 43rd Euro Working Group on Financial Modelling Meeting |

| Conference Date | 4-5/09/2008 |

| Publisher | Euro Working Group on Financial Modelling |

| Conference Location | Cass Business School, City University, London |

| Type of Work | Invited oral presentation |

| Key Words | research; electricity markets; day-ahead; futures contracts; hydro-thermal |

| Abstract | In this paper we develop a decision support procedure for a Price-Taker producer operating on Day- Ahead and Physical Derivatives Electricity Markets. The management of the electricity generation companies and their operation in the liberalized electricity market on a short-term horizon is an interesting problem in continuous evolution. Specifically, the incorporation of the Electricity Derivatives Market is the natural improvement in the Electricity Day-Ahead Markets in most countries in the world. Therefore, the inclusion of the management of derivatives products in generation company models is also a natural improvement of them. In this work, the derivatives products studied are the futures contracts. |

| URL | Click Here |

| Export | Tagged XML BibTex |