day-ahead market

A Short-term Scheduling Model for a Generation Company operating on Day-Ahead and Physical Derivatives Electricity Markets

Thu, 02/12/2009 - 12:36 — admin| Publication Type | Conference Paper |

| Year of Publication | 2009 |

| Authors | Vespucci, M.T.; Corchero, C.; Heredia, F.-Javier; Innorta, M. |

| Conference Name | Third FIMA International Conference |

| Conference Date | 19-22/01/2009 |

| Conference Location | Gressoney Saint Jean, Italy. |

| Editor | Federazione Italiana di Matematica Applicata |

| Type of Work | Invited oral presentation |

| Key Words | research; electricity markets; futures contracts; hydro-thermal |

| Abstract | A decision support procedure is developed for the short-term hydro-thermal resource scheduling problem of a Generation Company operating in the liberalized electric energy market and aiming at profit maximization. The generation company is supposed to be a price-taker, i.e. without influence on the electricity market price: therefore the profit maximization model of the problem faced by the GenCo must take into account both technical problems of generation and uncertainty of electricity prices. The power producer may hedge against the significant risk factor represented by energy market-price by participating in the Derivatives electricity Market. The derivatives products considered in this work are the futures contracts. T |

| URL | Click Here |

| Export | Tagged XML BibTex |

Optimal Bidding Strategies for Thermal and Generic Programming Units in the Day-ahead Electricity Market

Fri, 12/19/2008 - 10:57 — admin| Publication Type | Report |

| Year of Publication | 2008 |

| Authors | Heredia, F.-Javier, Rider, Marcos.-J., Corchero, C. |

| Pages | 12 |

| Date | 11/2008 |

| Reference | Research report DR 2008/13, Dept. of Statistics and Operations Research. E-Prints UPC, http://hdl.handle.net/2117/2468. Universitat Politècnica de Catalunya |

| Prepared for | Published on august 2010 at IEEE Transactions on Power Systems |

| Key Words | research; stochastic programming; electricity markets; day-ahead market, bilateral contracts; Virtual Power Plants; optimal bid |

| Abstract | This paper develops a stochastic programming model that integrates the day-ahead optimal bidding problem with the most recent regulation rules of the Iberian Electricity Market (MIBEL) for bilateral contracts, with a special consideration for the new mechanism to balance the competition of the production market, namely virtual power plants auctions (VPP). The model allows a price-taker generation company to decide the unit commitment of the thermal units, the economic dispatch of the bilateral contracts between the thermal units and the generic programming unit (GPU) and the optimal sale/purchase bids for all units (thermal and generic) observing the MIBEL regulation. The uncertainty of the spot prices is represented through scenario sets built from the most recent real data using scenario reduction techniques. The model was solved with real data from a Spanish generation company and spot prices, and the results are reported and analyzed. |

| URL | Click Here |

| Export | Tagged XML BibTex |

A stochastic programming model for the optimal electricity market bid problem with bilateral contracts for thermal and CC units

Thu, 10/09/2008 - 17:48 — admin

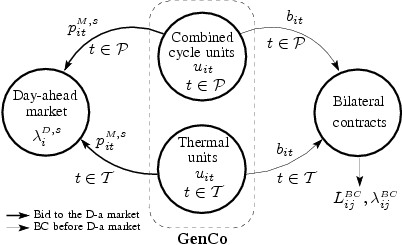

This work, co-authored by Dr. Marcos.-J Rider and Ms. Cristina Corchero and submitted to the journal Annals of Operations Research, developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the day-ahead optimal bid problem. This model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the bilateral contracts between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. See the full text at http://hdl.handle.net/2117/2282

A stochastic programming model for the optimal electricity market bid problem with bilateral contracts for thermal and combined cycle units

Thu, 10/09/2008 - 17:27 — admin| Publication Type | Report |

| Year of Publication | 2008 |

| Authors | Heredia, F.-Javier, Rider, Marcos.-J., Corchero, C. |

| Pages | 18 |

| Date | 10/2008 |

| Reference | Group on Numerical Optimization and Modelling, E-Prints UPC, http://hdl.handle.net/2117/2282. UPC. |

| Prepared for | Accepted for publication in Annals of Operations Research (2011) |

| City | Barcelona |

| Key Words | combined cycle units; optimal bid; bilateral contracts; day-ahead market; electricity markets; stochastic programming; modeling language; research |

| Abstract | This paper developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the day-ahead optimal bid problem. Our model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the BC between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. The model was solved using real data of a typical generation company and a set of scenarios for the Spanish market price. The results are reported and analyzed. |

| URL | Click Here |

| Export | Tagged XML BibTex |

A decision support procedure for a Price-Taker producer operating on Day-Ahead and Physical Derivatives Electricity Markets

Fri, 07/11/2008 - 18:28 — admin| Publication Type | Conference Paper |

| Year of Publication | 2008 |

| Authors | Cristina Corchero; F-Javier Heredia; M-Teresa Vespucci; Mario Innorta |

| Conference Name | V International Summer School in Risk Measurement and Control |

| Conference Date | 30/06-04/07/2008 |

| Publisher | Luiss Guido Carli University |

| Conference Location | Roma |

| Type of Work | Contributed oral presentation |

| Key Words | future contracts; electricity markets; stochastic programming; research |

| URL | Click Here |

| Export | Tagged XML BibTex |

Stochastic optimal day-ahead bid with physical future contracts

Tue, 06/10/2008 - 12:12 — admin| Publication Type | Conference Paper |

| Year of Publication | 2008 |

| Authors | Cristina Corchero; F.-Javier Heredia |

| Conference Name | International Workshop on Operational Research 2008 |

| Series Title | I.W.OR. International Workshop on Operations Research |

| Pagination | 77 |

| Conference Date | 05-07/06/2008 |

| Publisher | Dept. of Statistics and Operational Research, Univ. Rey Juan Carlos. |

| Conference Location | Dept. of Statistics and Operational Research, Univ. Rey Juan Carlos, Madrid, Spain. |

| Type of Work | Invited presentation |

| ISBN Number | 978-84-691-3994-3 |

| Key Words | stochastic programming; electricity markets; day-ahead market; futures contracts; MIBEL; modellization; research |

| Abstract |

The reorganization of electricity industry in Spain has finished a new step with the start-up of the Derivatives Market. Nowadays all electricity transactions in Spain and Portugal are managed jointly through the MIBEL by the Day-Ahead Market Operator and the Derivatives Market Operator. This new framework requires important changes in the short-term optimization strategies of the Generation Companies.

One main characteristic of MIBEL’s derivative market is the existence of short-term physical futures contracts; they imply the obligation to settle physically the energy. The regulation of our market establishes the mechanism for including those physical futures in the day-ahead bidding of the Generation Companies. Thus, the participation in the derivatives market changes the incomes function. The goal of this work is the optimization of the coordination between the physical products and the day-ahead bidding following this regulation because it could imply changes in the optimal planning, both in the optimal bidding and in the unit commitment.

We propose a stochastic mixed-integer programming model to coordinate the Day-Ahead Market and the physical futures contracts of the generation company. The model maximizes the expected profits taking into account futures contracts incomes. The model gives the optimal bidding strategy for the Day-Ahead Market as long as the simultaneous optimization for power planning production and day-ahead market bidding for the thermal units of a price-taker generation company. Thus, the model gives the optimal bid, particularly the instrumental-price bid quantity and its economic dispatch, and it provides the unit commitment. The uncertainty of the day-ahead market price is included in the stochastic model through a scenario tree. There has been applied both reduction and generation techniques for building this scenario tree from an ARIMA model. Results applying those different approaches are presented. The implementation is done with a modelling language. Implementation details and some first computational experiences for small real cases are presented. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Stochastic programming model for the day-ahead bid and bilateral contracts settlement problem

Tue, 06/10/2008 - 11:57 — admin| Publication Type | Conference Paper |

| Year of Publication | 2008 |

| Authors | F.-Javier Heredia; Marcos-J. Rider; Cristina Corchero |

| Conference Name | International Workshop on Operational Research 2008 |

| Series Title | I.W.OR. International Workshop on Operations Research |

| Pagination | 79 |

| Conference Date | 5-7/06/2008 |

| Publisher | Dept. of Statistics and Operational Research, Univ. Rey Juan Carlos. |

| Conference Location | Dept. of Statistics and Operational Research, Univ. Rey Juan Carlos, Madrid, Spain |

| Type of Work | Invited presentation |

| ISBN Number | 978-84-691-3994-3 |

| Key Words | stochastic programming; electricity markets; day-ahead market; bilateral contracts; Virtual Power Plant; Generic Programming Unit; MIBEL; modellization; research |

| Abstract | The new rules of electrical energy production market operation of the Spanish peninsular system (MIBEL) from the July 2007, bring new challenges in the modeling and solution of the production market operation. In order to increase the proportion of electricity that is purchased through bilateral contracts and to stimulate liquidity in forward electricity markets, the MIBEL rules imposes to the dominant utility companies in the Spanish peninsular Markets to hold a series of auctions offering virtual power plant (VPP) capacity to any party who is a member of the Spanish peninsular electricity market. In Spain, the VPP capacity means that the buyer of this product will have the capacity to generate MWh at his disposal. The energy resulting from the exercise of the VPP options can be used by buyers in several ways: covering national and international bilateral contracts prior to the day-ahead market; bidding to the day-ahead market and covering national bilateral contracts after the day-ahead market. This work develops a stochastic programming model that integrates the most recent regulation rules of the Spanish peninsular system for bilateral contracts, especially VPP auctions, in the day-ahead optimal bid problem. The model currently developed allows a price-taker generation company to decide the unit commitment of the thermal units, the economic dispatch of the bilateral contracts between the thermal and generic units and the optimal bid observing the Spanish peninsular regulation. The scenario tree representing the uncertainty of the spot prices is built applying reduction techniques to the tree obtained from an ARIMA model. The model was solved with real data of a Spanish generation company and market prices. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Planificación de la generación eléctrica a corto y largo plazo en un mercado liberalizado con contratos bilaterales (DPI2005-09117-C02-01).

Wed, 10/24/2007 - 23:39 — admin| Publication Type | Funded research projects |

| Year of Publication | 2005 |

| Authors | F.-Javier Heredia |

| Type of participation | Full time researcher |

| Duration | 01/2006-12/2008 |

| Funding organization | Ministerio de Educación y Ciencia |

| Partners | Departament d'Estadística i Investigació Operativa, Universidad Politèctica de Catalunya; Unión Fenosa |

| Full time researchers | 5 |

| Budget | 289.408'00€ |

| Project code | DPI2005-09117-C02-01 |

| Key Words | research; stochastic programming; electricity markets; future contracts; bilateral contracts; regulation markets; project; public; competitive; micinn; energy |

| Abstract | The project aims at two new features: the simultaneous consideration of bidding power to the liberalized market and of bilateral contracts (between a generation company and a consumer client), given the future elimination of the current regulations discouraging bilateral contracts, and the developement of optimization procedures more efficient than those employed now to solve these problems. This higher efficiency will allow a more accurate modeling and solving larger real problems in reasonable CPU time. In this project, both modeling languages and commercially available solvers in the one hand, and our own optimization algorithms in the other are employed. The algorithms to be developed include the use of: interior-point methods, global optimization, column-generation methods, and Lagrangian relaxation procedures employing dual methods |

| URL | Click Here |

| Export | Tagged XML BibTex |

Optimal Short-Term Strategies for a Generation Company in the MIBEL

Mon, 09/24/2007 - 18:29 — admin| Publication Type | Conference Paper |

| Year of Publication | 2006 |

| Authors | Corchero, C.; Heredia, F. J. |

| Conference Name | APMOD 2006: Applied Mathematical Programming and Modellization |

| Conference Date | 19-21/06/06 |

| Conference Location | Madrid |

| Editor | Universidad Rey Juan carlos, Universidad Pontificia de Comillas |

| Type of Work | Contributed session |

| Key Words | stochastic programming; electricity markets; day-ahead market; future contracts; research |

| Abstract | MIBEL, the future Spanish and Portuguese electricity market, is expected to start in 2007 and one of the most important changes will be the creation of short-term futures markets, such as daily and weekly futures contracts. This new framework will require important changes in the short term optimization strategies of the generation companies. We propose a methodology to coordinate the day-ahead market and the new daily futures market proposed in the MIBEL. This coordination is particularly important in physical futures contracts; they imply the obligation to supply energy and could change the optimal power planning. The methodology is based on stochastic mixed-integer programming and gives the optimal bid in the futures markets as long as the simultaneous optimization for power planning production and day-ahead market bidding for the thermal units of a price-taker generation company. The approach presented is stochastic because of the uncertainty of the spot and futures market prices. We use time series techniques to model the market prices and we introduce them in the optimization model by an optimally generated scenario tree. The implementation is done with a modelling language. Implementation details and some first computational experiences for small cases are presented. |

| URL | Click Here |

| Export | Tagged XML BibTex |

A mixed-integer stochastic programming model for the day-ahead and futures energy markets coordination

Sat, 09/22/2007 - 12:55 — admin| Publication Type | Conference Paper |

| Year of Publication | 2007 |

| Authors | Corchero, C.; Heredia, F. J. |

| Conference Name | EURO XXII: 2nd European Conference on Operational Reserach |

| Conference Date | 08/07/2007 |

| Publisher | The Association of European Operational Research Societies |

| Conference Location | Prague, Czech Republic |

| Type of Work | Oral presentacion |

| Key Words | stochastic programming; electricity markets; day-ahead market; future contracts; research |

| Abstract | The participation in spot-market and in financial markets has traditionally been studied independently but there are some evidences that indicate it could be interesting a joint approach. We propose a methodology based on stochastic mixed-integer programming to coordinate the day-ahead market and the physical futures contracts. It gives the optimal bid for the spot-market as long as the simultaneous optimization for power planning production and day-ahead market bidding for the thermal units of a price-taker generation company. Implementation details and some first computational experiences for small real cases are presented. |

| URL | Click Here |

| Export | Tagged XML BibTex |