combined cycle units

Stochastic optimal generation bid to electricity markets with emissions risk constraints.

Tue, 01/30/2018 - 21:12 — admin| Publication Type | Journal Article |

| Year of Publication | 2018 |

| Authors | F.-Javier Heredia; Julián Cifuentes-Rubiano; Cristina Corchero |

| Journal Title | Journal of Environmental Management |

| Volume | 207 |

| Issue | 1 |

| Pages | 12 |

| Start Page | 432 |

| Journal Date | February 2018 |

| Publisher | Elsevier |

| ISSN Number | 0301-4797 |

| Key Words | research; OR in Energy; Stochastic Programming; Risk Management; Electricity market; Emissions reduction; paper |

| Abstract | There are many factors that influence the day-ahead market bidding strategies of a generation company (GenCo) within the framework of the current energy market. Environmental policy issues are giving rise to emission limitation that are becoming more and more important for fossil-fueled power plants, and these must be considered in their management. This work investigates the influence of the emissions reduction plan and the incorporation of the medium-term derivative commitments in the optimal generation bidding strategy for the day-ahead electricity market. Two different technologies have been considered: the high-emission technology of thermal coal units and the low-emission technology of combined cycle gas turbine units. The Iberian Electricity Market (MIBEL) and the Spanish National Emissions Reduction Plan (NERP) defines the environmental framework for dealing with the day-ahead market bidding strategies. To address emission limitations, we have extended some of the standard risk management methodologies developed for financial markets, such as Value-at-Risk (VaR) and Conditional Value-at-Risk (CVaR), thus leading to the new concept of Conditional Emission at Risk (CEaR). This study offers electricity generation utilities a mathematical model for determining the unit’s optimal generation bid to the wholesale electricity market such that it maximizes the long-term profits of the utility while allowing it to abide by the Iberian Electricity Market rules as well as the environmental restrictions set by the Spanish National Emissions Reduction Plan. We analyze the economic implications for a GenCo that includes the environmental restrictions of this National Plan as well as the NERP’s effects on the expected profits and the optimal generation bid. |

| URL | Click Here |

| DOI | 10.1016/j.jenvman.2017.11.010 |

| Preprint | http://hdl.handle.net/2117/114024 |

| Export | Tagged XML BibTex |

Stochastic Optimal Bid to Electricity Markets with Emission Risk Constraints

Thu, 11/27/2014 - 21:20 — admin| Publication Type | Conference Paper |

| Year of Publication | 2014 |

| Authors | F.-Javier Heredia; Julián Cifuentes; Cristina Corchero |

| Conference Name | IFORS2014: 20th Conference of the International Federation of Operational Research Societies |

| Conference Date | 13-18/07/2014 |

| Conference Location | Barcelona |

| Type of Work | Invited presentation |

| Key Words | research; emission limits; risk; stochastic programming; day-ahead electricity market; combined cycle units |

| Abstract | This work allows investigating the influence of the emission reduction plan, and the incorporation of the derivatives medium-term commitments in the optimal generation bidding strategy to the day-ahead electricity market. Two different technologies have been considered: the coal thermal units, high-emission technology, and the combined cycle gas turbine units, low-emission technology. The Iberian Electricity Market (MIBEL) and the Spanish National Emission Reduction Plan (NERP) defines the environmental framework to deal with by the day-ahead market bidding strategies. To address emission limitations, some of the standard risk management methodologies developed for financial markets, such as Value-at-Risk (VaR) and Conditional Valueat- Risk (CVaR), have been extended giving rise to the new concept of Conditional Emission at Risk (CEaR). The economic implications for a GenCo of including the environmental restrictions of this National Plan are analyzed, and the effect of the NERP in the expected profits and optimal generation bid are analyzed. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Stochastic optimal generation bid to electricity markets with emission risk constraints.

Sun, 11/17/2013 - 19:22 — admin| Publication Type | Report |

| Year of Publication | 2013 |

| Authors | F.-Javier Heredia; Julian Cifuentes; Cristina Corchero |

| Pages | 21 |

| Date | 09/2013 |

| Reference | Research report DR 2013/04, Dept. of Statistics and Operations Research. E-Prints UPC, http://hdl.handle.net/2117/20640. Universitat Politècnica de Catalunya |

| Prepared for | submitted |

| Key Words | research; OR in Energy; Stochastic Programming; Risk Management; Electricity market; Emission reduction |

| Abstract | There are many factors that influence the day-ahead market bidding strategies of a generation company (GenCo) in the current energy market framework. Environmental policy issues have become more and more important for fossil-fuelled power plants and they have to be considered in their management, giving rise to emission limitations. This work allows investigating the influence of the emission reduction plan, and the incorporation of the derivatives medium-term commitments in the optimal generation bidding strategy to the day-ahead electricity market. Two different technologies have been considered: the coal thermal units, high-emission technology, and the combined cycle gas turbine units, low-emission technology. The Iberian Electricity Market (MIBEL) and the Spanish National Emission Reduction Plan (NERP) defines the environmental framework to deal with by the day-ahead market bidding strategies. To address emission limitations, some of the standard risk management methodologies developed for financial markets, such as Value-at-Risk (VaR) and Conditional Value-at-Risk (CVaR), have been extended giving rise to the new concept of Conditional Emission-at-Risk (CEaR). This study offers to electricity generation utilities a mathematical model to determinate the individual optimal generation bid to the wholesale electricity market, for each one of their generation units that maximizes the long-run profits of the utility abiding by the Iberian Electricity Market rules, as well as the environmental restrictions set by the Spanish National Emissions Reduction Plan. The economic implications for a GenCo of including the environmental restrictions of this National Plan are analyzed, and the effect of the NERP in the expected profits and optimal generation bid are analyzed. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Optimal electricity market bidding strategies considering emission allowances

Thu, 07/19/2012 - 10:31 — admin| Publication Type | Conference Paper |

| Year of Publication | 2012 |

| Authors | Cristina Corchero; F.-Javier Heredia; Julián Cifuentes |

| Conference Name | 9th International Conference on the European Energy Market (EEM12) |

| Conference Date | 10-12/05/2012 |

| Conference Location | Florence, Italy |

| Type of Work | Contributed presentation |

| Key Words | research; elecriticy; markets; CO2 allowances; emissions limits; environment; stochastic programming; modeling languages |

| Abstract | There are many factors that influence the day-ahead market bidding strategies of a GenCo in the current energy market framework. In this work we study the influence of both the allowances and emission reduction plan and the incorporation of the derivatives medium-term commitments in the optimal generation bidding strategy to the day-ahead electricity market. Two different technologies have been considered: the coal thermal units, high-emission technology, and the combined cycle gas turbine units, low-emission technology. The operational characteristics of both kinds of units are modeled in detail. We deal with this problem in the framework of the Iberian Electricity Market and the Spanish National Emissions and Allocation Plans. The economic implications for a GenCo of including the environmental restrictions of these National Plans are analyzed. |

| URL | Click Here |

| Export | Tagged XML BibTex |

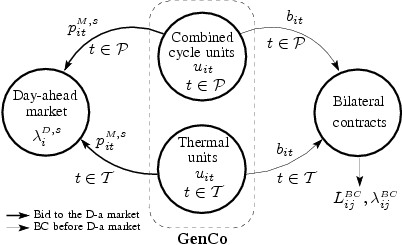

A stochastic programming model for the optimal electricity market bid problem with bilateral contracts for thermal and combined cycle units

Sun, 01/16/2011 - 23:55 — admin| Publication Type | Journal Article |

| Year of Publication | 2012 |

| Authors | F.-Javier Heredia; Marcos J. Rider; C. Corchero |

| Journal Title | Annals of Operations Research |

| Volume | 193 |

| Issue | 1 |

| Pages | 107-127 |

| Start Page | 107 |

| Journal Date | 2012 |

| Publisher | Springer |

| ISSN Number | 0254-5330 |

| Key Words | research; paper; stochastic programming; day-ahead market; combined cycle; bilateral contracts; modeling; DPI2008-02154 |

| Abstract | This paper develops a stochastic programming model that integrates the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the dayahead optimal bid problem. Our model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the bilateral contract between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. The model was solved using real data of a typical generation company and a set of scenarios for the Spanish market price. The results are reported and analyzed. The main contributions of this paper include: (a) a new model for the optimal bid function and matched energy for thermal and CC units, (b) a new and detailed mixed-integer formulation of the operation rules of the CC units and (c) the joint optimization of all the above-mentioned factors together with the BC duties. The model was tested with real data of market prices and programming units of a GenCo operating in the Spanish electricity market. |

| URL | Click Here |

| DOI | 10.1007/s10479-011-0847-x |

| Preprint | http://hdl.handle.net/2117/2282 |

| Export | Tagged XML BibTex |

New paper accepted for publication in Annals of Operations Research

Wed, 01/12/2011 - 16:47 — admin

The work A stochastic programming model for the optimal electricity market bid problem with bilateral contracts for thermal and combined cycle units of F.-Javier Heredia, Marcos J. Rider and C. Corchero has been accepted for publication in the journal Annals of Operations Research. A preliminary version of the manuscript is available at E-Prints UPC http://hdl.handle.net/2117/2282. This study, which was developed as a part of the research project DPI2008-02153, allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the bilateral contract between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation.

Optimal Bidding Strategies for Thermal and Combined Cycle Units in the Day-ahead Electricity Market with Bilateral Contracts

Fri, 05/28/2010 - 09:58 — admin| Publication Type | Proceedings Article |

| Year of Publication | 2009 |

| Authors | Heredia, F.-Javier; Rider, Marcos.-J.; Corchero, C. |

| Conference Name | 2009 Power Engineering Society General Meeting |

| Pagination | 1-6 |

| Conference Start Date | 26/07/2010 |

| Publisher | IEEE |

| Conference Location | Calgary |

| ISSN Number | 1944-9925 |

| ISBN Number | 978-1-4244-4241-6 |

| Key Words | research; Electricity spot-market; bilateral contracts; combined cycle units; optimal bidding strategies; short-term electricity generation planning; stochastic programming; paper |

| Abstract | This paper developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the day-ahead optimal bid problem. Our model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the BC between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. The model was solved using real data of a typical generation company and a set of scenarios for the Spanish market price. The results are reported and analyzed. |

| URL | Click Here |

| DOI | 10.1109/PES.2009.5275680 |

| Export | Tagged XML BibTex |

Optimal Bidding Strategies for Thermal and Combined Cycle Units in the Day-ahead Electricity Market with Bilateral Contracts

Tue, 09/08/2009 - 10:28 — admin| Publication Type | Conference Paper |

| Year of Publication | 2009 |

| Authors | Heredia, F.-Javier; Rider, Marcos.-J.; Corchero, C. |

| Conference Name | 2009 Power Engineering Society General Meeting |

| Series Title | Proceedings of the Power Engineering Society General Meeting, 2009. IEEE |

| Volume | 1 |

| Pagination | 1-6 |

| Conference Date | 26-30/07/2009 |

| Publisher | IEEE |

| Conference Location | Calgary, Alberta, Canada |

| Editor | IEEE |

| Type of Work | Contributed oral presentation |

| ISSN Number | 1944-9925 |

| ISBN Number | 978-1-4244-4241-6 |

| Key Words | research; stochastic programming; electricity markets; day-ahead market, bilateral contracts; Combined Cycle Units; optimal bid |

| Abstract | This paper developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the dayahead optimal bid problem. Our model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the BC between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. The model was solved using real data of a typical generation company and a set of scenarios for the Spanish market price. The results are reported and analyzed. |

| URL | Click Here |

| DOI | 10.1109/PES.2009.5275680 |

| Export | Tagged XML BibTex |

A stochastic programming model for the optimal electricity market bid problem with bilateral contracts for thermal and CC units

Thu, 10/09/2008 - 17:48 — admin

This work, co-authored by Dr. Marcos.-J Rider and Ms. Cristina Corchero and submitted to the journal Annals of Operations Research, developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the day-ahead optimal bid problem. This model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the bilateral contracts between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. See the full text at http://hdl.handle.net/2117/2282

A stochastic programming model for the optimal electricity market bid problem with bilateral contracts for thermal and combined cycle units

Thu, 10/09/2008 - 17:27 — admin| Publication Type | Report |

| Year of Publication | 2008 |

| Authors | Heredia, F.-Javier, Rider, Marcos.-J., Corchero, C. |

| Pages | 18 |

| Date | 10/2008 |

| Reference | Group on Numerical Optimization and Modelling, E-Prints UPC, http://hdl.handle.net/2117/2282. UPC. |

| Prepared for | Accepted for publication in Annals of Operations Research (2011) |

| City | Barcelona |

| Key Words | combined cycle units; optimal bid; bilateral contracts; day-ahead market; electricity markets; stochastic programming; modeling language; research |

| Abstract | This paper developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the day-ahead optimal bid problem. Our model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the BC between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. The model was solved using real data of a typical generation company and a set of scenarios for the Spanish market price. The results are reported and analyzed. |

| URL | Click Here |

| Export | Tagged XML BibTex |