DPI2008-02153

Stochastic optimal generation bid to electricity markets with emission risk constraints.

Sun, 11/17/2013 - 19:22 — admin| Publication Type | Report |

| Year of Publication | 2013 |

| Authors | F.-Javier Heredia; Julian Cifuentes; Cristina Corchero |

| Pages | 21 |

| Date | 09/2013 |

| Reference | Research report DR 2013/04, Dept. of Statistics and Operations Research. E-Prints UPC, http://hdl.handle.net/2117/20640. Universitat Politècnica de Catalunya |

| Prepared for | submitted |

| Key Words | research; OR in Energy; Stochastic Programming; Risk Management; Electricity market; Emission reduction |

| Abstract | There are many factors that influence the day-ahead market bidding strategies of a generation company (GenCo) in the current energy market framework. Environmental policy issues have become more and more important for fossil-fuelled power plants and they have to be considered in their management, giving rise to emission limitations. This work allows investigating the influence of the emission reduction plan, and the incorporation of the derivatives medium-term commitments in the optimal generation bidding strategy to the day-ahead electricity market. Two different technologies have been considered: the coal thermal units, high-emission technology, and the combined cycle gas turbine units, low-emission technology. The Iberian Electricity Market (MIBEL) and the Spanish National Emission Reduction Plan (NERP) defines the environmental framework to deal with by the day-ahead market bidding strategies. To address emission limitations, some of the standard risk management methodologies developed for financial markets, such as Value-at-Risk (VaR) and Conditional Value-at-Risk (CVaR), have been extended giving rise to the new concept of Conditional Emission-at-Risk (CEaR). This study offers to electricity generation utilities a mathematical model to determinate the individual optimal generation bid to the wholesale electricity market, for each one of their generation units that maximizes the long-run profits of the utility abiding by the Iberian Electricity Market rules, as well as the environmental restrictions set by the Spanish National Emissions Reduction Plan. The economic implications for a GenCo of including the environmental restrictions of this National Plan are analyzed, and the effect of the NERP in the expected profits and optimal generation bid are analyzed. |

| URL | Click Here |

| Export | Tagged XML BibTex |

New paper published in the International Statistical Review.

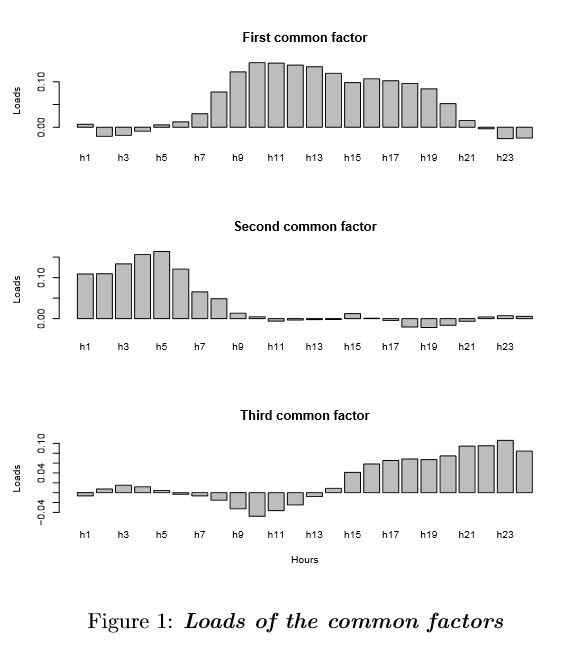

Fri, 09/06/2013 - 16:19 — admin The paper Improving Electricity Market Price Forecasting with Factor Models for the Optimal Generation Bid has been recently published in the journal International Statistical Review (preprint available at http://hdl.handle.net/2117/3047 ). In this article, we apply forecasting factor models to the market framework in Spain and Portugal and study their performance. Although their goodness of fit is similar to that of autoregressive integrated moving average models, they are easier to implement. The second part of the paper uses the spot-price forecasting model to generate inputs for a stochastic programming model, which is then used to determine the company's optimal generation bid. This work is a partial result of the tasks developped in the research project DPI2008-02153 of the MINECO.

The paper Improving Electricity Market Price Forecasting with Factor Models for the Optimal Generation Bid has been recently published in the journal International Statistical Review (preprint available at http://hdl.handle.net/2117/3047 ). In this article, we apply forecasting factor models to the market framework in Spain and Portugal and study their performance. Although their goodness of fit is similar to that of autoregressive integrated moving average models, they are easier to implement. The second part of the paper uses the spot-price forecasting model to generate inputs for a stochastic programming model, which is then used to determine the company's optimal generation bid. This work is a partial result of the tasks developped in the research project DPI2008-02153 of the MINECO.

A new optimal electricity market bid model solved through perspective cuts

Fri, 09/06/2013 - 15:58 — admin| Publication Type | Report |

| Year of Publication | 2011 |

| Authors | Cristina Corchero; Eugenio Mijangos; F.-Javier Heredia |

| Pages | 25 |

| Date | 11/2011 |

| Reference | Research report DR 2011/04, Dept. of Statistics and Operations Research. E-Prints UPC, http://hdl.handle.net/2117/18368. Universitat Politècnica de Catalunya |

| Prepared for | Published by TOP |

| Key Words | research; electricity market; |

| Abstract | On current electricity markets the electrical utilities are faced with very sophisticated decision making problems under uncertainty. Moreover, when focusing in the shortterm management, generation companies must include some medium-term products that directly influence their short-term strategies. In this work, the bilateral and physical futures contracts are included into the day-ahead market bid following MIBEL rules and a stochastic quadratic mixed-integer programming model is presented. The complexity of this stochastic programming problem makes unpractical the resolution of large-scale instances with general purpose optimization codes. Therefore, in order to gain efficiency, a polyhedral outer approximation of the quadratic objective function obtained by means of perspective cuts (PC) is proposed. A set of instances of the problem has been defined with real data and solved with the PC methodology. The numerical results obtained show the efficiency of this methodology compared with standard mixed quadratic optimization solvers. |

| URL | Click Here |

| Export | Tagged XML BibTex |

A new paper published on optimal electricity market bid through perspective cuts.

Fri, 09/06/2013 - 15:13 — admin The paper A new optimal electrcity market bid model solved through perspective cuts has been recently published in the journal TOP, Springer (preprint available here). In this work, the perspective cut methodology for the resolution of large scale quadratic semi-continuous optimization problems are porposed to solve stochastic programming models arising in some optimal bid electrcitiy market related problems. The numerical results obtained show the efficiency of this methodology compared with standard mixed quadratic optimization solvers. This work is a partial result of the tasks developed in the research project DPI2008-02153 of the MINECO.

The paper A new optimal electrcity market bid model solved through perspective cuts has been recently published in the journal TOP, Springer (preprint available here). In this work, the perspective cut methodology for the resolution of large scale quadratic semi-continuous optimization problems are porposed to solve stochastic programming models arising in some optimal bid electrcitiy market related problems. The numerical results obtained show the efficiency of this methodology compared with standard mixed quadratic optimization solvers. This work is a partial result of the tasks developed in the research project DPI2008-02153 of the MINECO.

Improving Electricity Market Price Forecasting with Factor Models for the Optimal Generation Bid

Fri, 09/06/2013 - 14:58 — admin| Publication Type | Journal Article |

| Year of Publication | 2013 |

| Authors | M.Pilar Muñoz; Cristina Corchero; F.-Javier Heredia |

| Journal Title | International Statistical Review |

| Volume | 81 |

| Issue | 2 |

| Pages | 18 (289-306) |

| Start Page | 289 |

| Journal Date | August 2013 |

| Publisher | Wiley |

| ISSN Number | 1751-5823 |

| Key Words | research; paper; electricity market prices; short-term forecasting; stochastic programming; factor models; price scenarios; Q2 |

| Abstract | In liberalized electricity markets, the electricity generation companies usually manage their production by developing hourly bids that are sent to the day-ahead market. As the prices at which the energy will be purchased are unknown until the end of the bidding process, forecasting of spot prices has become an essential element in electricity management strategies. In this article, we apply forecasting factor models to the market framework in Spain and Portugal and study their performance. Although their goodness of fit is similar to that of autoregressive integrated moving average models, they are easier to implement. The second part of the paper uses the spot-price forecasting model to generate inputs for a stochastic programming model, which is then used to determine the company's optimal generation bid. The resulting optimal bidding curves are presented and analyzed in the context of the Iberian day-ahead electricity market. |

| URL | Click Here |

| DOI | 10.1111/insr.12014 |

| Preprint | http://hdl.handle.net/2117/3047 |

| Export | Tagged XML BibTex |

New paper on efficient optimization methods for quadratic stochastic programming problems.

Wed, 03/27/2013 - 13:08 — admin The proceeding paper Solving Electric Market Quadratic Problems by Branch and Fix Coordination Methods has been published by Springer in the series IFIP Advances in Information and Communication Technology (doi:10.1007/978-3-642-36062-6_51). In this paper the Branch&Fix Coordination methodology is applied to the solution of an specific class of quadratic two-stage stochastic programming problems arising in the field of the electricity market optimization. This work has been supported by the research project grant DPI2008-02153 of the MINECO.

The proceeding paper Solving Electric Market Quadratic Problems by Branch and Fix Coordination Methods has been published by Springer in the series IFIP Advances in Information and Communication Technology (doi:10.1007/978-3-642-36062-6_51). In this paper the Branch&Fix Coordination methodology is applied to the solution of an specific class of quadratic two-stage stochastic programming problems arising in the field of the electricity market optimization. This work has been supported by the research project grant DPI2008-02153 of the MINECO.

Solving Electric Market Quadratic Problems by Branch and Fix Coordination Methods

Tue, 03/05/2013 - 16:24 — admin| Publication Type | Proceedings Article |

| Year of Publication | 2013 |

| Authors | F. -Javier Heredia; Cristina Corchero; Eugenio Mijangos |

| Conference Name | 25th IFIP TC 7 Conference, CSMO 2011 |

| Series Title | IFIP Advances in Information and Communication Technology |

| Volume | 391 |

| Pagination | 511-520 |

| Conference Start Date | 12/09/2011 |

| Publisher | Springer Berlin Heidelberg |

| Conference Location | Berlin |

| ISSN Number | 1868-4238 |

| ISBN Number | 978-3-642-36062-6 |

| Key Words | Liberalized Electricity Market; Optimal Bid Stochastic Programming; Quadratic Branch-and-Fix Coordination; research; paper; DPI2008-02153 |

| Abstract | The electric market regulation in Spain (MIBEL) establishes the rules for bilateral and futures contracts in the day-ahead optimal bid problem. Our model allows a price-taker generation company to decide the unit commitment of the thermal units, the economic dispatch of the bilateral and futures contracts between the thermal units and the optimal sale bids for the thermal units observing the MIBEL regulation. The uncertainty of the spot prices is represented through scenario sets. We solve this model on the framework of the Branch and Fix Coordination metodology as a quadratic two-stage stochastic problem. In order to gain computational efficiency, we use scenario clusters and propose to use perspective cuts. Numerical results are reported. |

| URL | Click Here |

| DOI | 10.1007/978-3-642-36062-6_51 |

| Export | Tagged XML BibTex |

Optimal electricity market bidding strategies considering emission allowances

Thu, 07/19/2012 - 20:45 — admin| Publication Type | Proceedings Article |

| Year of Publication | 2012 |

| Authors | Cristina Corchero; F.-Javier Heredia; Julián Cifuentes |

| Conference Name | 2012 9th International Conference on the European Energy Market (EEM 2012) |

| Series Title | IEEE Conference Publications |

| Pagination | 1-8 |

| Conference Start Date | 10/05/2012 |

| Publisher | IEEE |

| Conference Location | Florence |

| Editor | IEEE |

| ISSN Number | - |

| ISBN Number | 978-1-4673-0834-2 |

| Key Words | research; elecriticy; markets; CO2 allowances; emissions limits; environment; stochastic programming; modeling languages; paper |

| Abstract | There are many factors that influence the day-ahead market bidding strategies of a GenCo in the current energy market framework. In this work we study the influence of both the allowances and emission reduction plan and the incorporation of the derivatives medium-term commitments in the optimal generation bidding strategy to the day-ahead electricity market. Two different technologies have been considered: the coal thermal units, high-emission technology, and the combined cycle gas turbine units, low-emission technology. The operational characteristics of both kinds of units are modeled in detail. We deal with this problem in the framework of the Iberian Electricity Market and the Spanish National Emissions and Allocation Plans. The economic implications for a GenCo of including the environmental restrictions of these National Plans are analyzed. |

| URL | Click Here |

| DOI | 10.1109/EEM.2012.6254676 |

| Preprint | http://hdl.handle.net/2117/18691 |

| Export | Tagged XML BibTex |

Optimal sale bid for a wind producer in Spanish electricity market through stochastic programming

Thu, 07/19/2012 - 20:08 — admin| Publication Type | Conference Paper |

| Year of Publication | 2012 |

| Authors | Simona Sacripante; F.-Javier Heredia; Cristina Corchero |

| Conference Name | 9th International Conference on Computational Management Science. |

| Conference Date | 18-20/04/2012 |

| Conference Location | London |

| Type of Work | Invited presentation |

| Key Words | research; stochastic programming; wind producer; renewable energy; multimarket; electricity market; optimal bid; DPI2008-02153 |

| Abstract | Wind power generation has a key role in Spanish electricity system since it is a native source of energy that could help Spain to reduce its dependency on the exterior for the production of electricity. Apart from the great environmental benefits produced, wind energy reduce considerably spot energy price, reaching to cover 16,6 % of peninsular demand. Although, wind farms show high investment costs and need an efficient incentive scheme to be financed. If on one hand, Spain has been a leading country in Europe in developing a successful incentive scheme, nowadays tariff deficit and negative economic conjunctures asks for consistent reductions in the support mechanism and demand wind producers to be able to compete into the market with more mature technologies. The objective of this work is to find an optimal commercial strategy in the production market that would allow wind producer to maximize their daily profit. That can be achieved on one hand, increasing incomes in day-ahead and intraday markets, on the other hand, reducing deviation costs due to error in generation predictions. We will previously analyze market features and common practices in use and then develop our own sale strategy solving a two-stage linear stochastic optimization problem. The first stage variable will be the sale bid in the day–ahead market while second stage variables will be the offers to the six sessions of intraday market. The model is implemented using real data from a wind producer leader in Spain. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Optimal electricity market bidding strategies considering emission allowances

Thu, 07/19/2012 - 10:31 — admin| Publication Type | Conference Paper |

| Year of Publication | 2012 |

| Authors | Cristina Corchero; F.-Javier Heredia; Julián Cifuentes |

| Conference Name | 9th International Conference on the European Energy Market (EEM12) |

| Conference Date | 10-12/05/2012 |

| Conference Location | Florence, Italy |

| Type of Work | Contributed presentation |

| Key Words | research; elecriticy; markets; CO2 allowances; emissions limits; environment; stochastic programming; modeling languages |

| Abstract | There are many factors that influence the day-ahead market bidding strategies of a GenCo in the current energy market framework. In this work we study the influence of both the allowances and emission reduction plan and the incorporation of the derivatives medium-term commitments in the optimal generation bidding strategy to the day-ahead electricity market. Two different technologies have been considered: the coal thermal units, high-emission technology, and the combined cycle gas turbine units, low-emission technology. The operational characteristics of both kinds of units are modeled in detail. We deal with this problem in the framework of the Iberian Electricity Market and the Spanish National Emissions and Allocation Plans. The economic implications for a GenCo of including the environmental restrictions of these National Plans are analyzed. |

| URL | Click Here |

| Export | Tagged XML BibTex |