multimarket

Optimal sale bid for a wind producer in Spanish electricity market through stochastic programming

Thu, 07/19/2012 - 20:08 — admin| Publication Type | Conference Paper |

| Year of Publication | 2012 |

| Authors | Simona Sacripante; F.-Javier Heredia; Cristina Corchero |

| Conference Name | 9th International Conference on Computational Management Science. |

| Conference Date | 18-20/04/2012 |

| Conference Location | London |

| Type of Work | Invited presentation |

| Key Words | research; stochastic programming; wind producer; renewable energy; multimarket; electricity market; optimal bid; DPI2008-02153 |

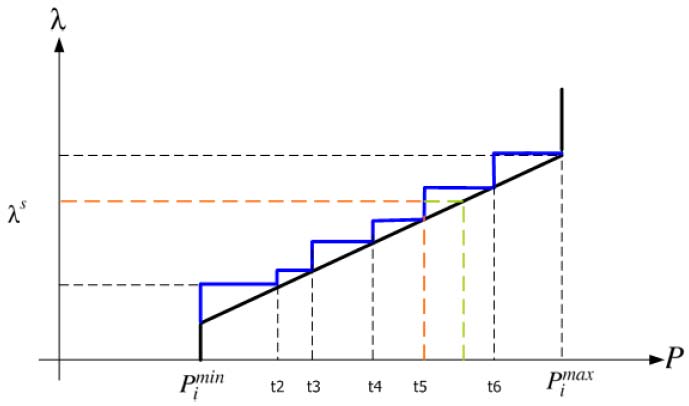

| Abstract | Wind power generation has a key role in Spanish electricity system since it is a native source of energy that could help Spain to reduce its dependency on the exterior for the production of electricity. Apart from the great environmental benefits produced, wind energy reduce considerably spot energy price, reaching to cover 16,6 % of peninsular demand. Although, wind farms show high investment costs and need an efficient incentive scheme to be financed. If on one hand, Spain has been a leading country in Europe in developing a successful incentive scheme, nowadays tariff deficit and negative economic conjunctures asks for consistent reductions in the support mechanism and demand wind producers to be able to compete into the market with more mature technologies. The objective of this work is to find an optimal commercial strategy in the production market that would allow wind producer to maximize their daily profit. That can be achieved on one hand, increasing incomes in day-ahead and intraday markets, on the other hand, reducing deviation costs due to error in generation predictions. We will previously analyze market features and common practices in use and then develop our own sale strategy solving a two-stage linear stochastic optimization problem. The first stage variable will be the sale bid in the day–ahead market while second stage variables will be the offers to the six sessions of intraday market. The model is implemented using real data from a wind producer leader in Spain. |

| URL | Click Here |

| Export | Tagged XML BibTex |

A multistage stochastic programming model for the optimal multimarket electricity bid problem

Wed, 10/26/2011 - 15:01 — admin| Publication Type | Conference Paper |

| Year of Publication | 2011 |

| Authors | F.-Javier Heredia; Cristina Corchero |

| Conference Name | Optimization, Theory, Algorithms and Applications in Economics (OPT 2011) |

| Conference Date | 24-28/10/2011 |

| Conference Location | Centre de Recerca Matemàtica. Barcelona, Spain. |

| Type of Work | Invited presentation |

| Key Words | research; optimal bid; day-ahead electricity market; multimarket; perspective cuts; bilateral contracts; futures contracts; stochastic programming; DPI2008-02153 |

| Abstract | Short-term electricity market is made up of a sequence of markets, that is, it is a multimarket enviroment. In the case of the Iberian Energy Market the sequence of major short-term electricity markets are the day-ahead market, the ancillary service market or secondary reserve market (henceforth reserve market), and a set of six intraday markets. Generation Companies (GenCos) that participate in the electricity market could increase their benefits by jointly optimizing their participation in this sequence of electricity markets. This work proposes a stochastic programming model that gives the GenCo the optimal bidding strategy for the day-ahead market (DAM), which considers the benefits and costs of participating in the subsequent markets and which includes both physical futures contracts and bilateral contracts. Numerical results are reported and discussed. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Optimal sale bid for a wind producer in Spanish electricity market

Wed, 10/26/2011 - 13:56 — admin| Publication Type | Tesis de Grau i Màster // BSc and MSc Thesis |

| Year of Publication | 2011 |

| Authors | Simona Sacripante |

| Director | F.-Javier Heredia |

| Tipus de tesi | MSc Thesis |

| Titulació | Master in Statistics and Operations Research |

| Centre | Faculty of Mathematics and Statistics |

| Data defensa | 10/11/2011 |

| Nota // mark | 9 / 10 |

| Key Words | teaching; renewebable energy; electricity market; optimal bid; wind generators; wind; intraday market; wind producer; MSc Thesis |

| Abstract | The objective of this work is to find an optimal commercial strategy in the production market that would allow wind producer to maximize their daily profit. That can be achieved on one hand, increasing incomes in day-ahead and intraday markets, on the other hand, reducing deviation costs due to error in generation predictions. |

| DOI / handle | http://hdl.handle.net/2099.1/13914 |

| URL | Click Here |

| Export | Tagged XML BibTex |

Efficient Solution of Optimal Multimarket Electricity Bid Models

Mon, 05/30/2011 - 15:59 — admin| Publication Type | Proceedings Article |

| Year of Publication | 2011 |

| Authors | Cristina Corchero; F.-Javier Heredia; Eugenio Mijangos |

| Conference Name | 8th International Conference on the European Energy Market (EEM11) |

| Series Title | To be published in the IEEEXplore |

| Pagination | 244-249 |

| Conference Start Date | 25/05/2011 |

| Publisher | Institute of Electrical and Electronics Engineers, Inc. |

| Conference Location | Zagreb, Croatia |

| Editor | Marko Delimar |

| ISBN Number | 978-1-61284-286-8/11 |

| Key Words | spot electricity markets; financial electricity markets; Iberian Electricity Market; stochastic programming; perspective cuts; research; DPI2008-02153; paper |

| Abstract | Short-term electricity market is made up of a sequence of markets, that is, it is a multimarket enviroment. In the case of the Iberian Energy Market the sequence of major short-term electricity markets are the day-ahead market, the ancillary service market or secondary reserve market (henceforth reserve market), and a set of six intraday markets. Generation Companies (GenCos) that participate in the electricity market could increase their benefits by jointly optimizing their participation in this sequence of electricity markets. This work proposes a stochastic programming model that gives the GenCo the optimal bidding strategy for the day-ahead market (DAM), which considers the benefits and costs of participating in the subsequent markets and which includes both physical futures contracts and bilateral contracts. |

| URL | Click Here |

| DOI | 10.1109/EEM.2011.5953017 |

| Export | Tagged XML BibTex |

Efficient Solution of Optimal Multimarket Electricity Bid Models

Mon, 05/30/2011 - 15:45 — admin| Publication Type | Conference Paper |

| Year of Publication | 2011 |

| Authors | Cristina Corchero; F.-Javier Heredia; Eugenio Mijangos |

| Conference Name | 8th International Conference on the European Energy Market (EEM11) |

| Series Title | International Conference on the European Energy Market |

| Conference Date | 25-27/05/2011 |

| Publisher | Institute of Electrical and Electronics Engineers, Inc. |

| Conference Location | Zagreb, Croatia |

| Editor | Marko Delimar |

| Type of Work | Contributed presentacion |

| ISBN Number | 978-1-61284-284-4 |

| Key Words | spot electricity markets; financial electricity markets; Iberian Electricity Market; stochastic programming; perspective cuts; research; DPI2008-02153 |

| Abstract | Short-term electricity market is made up of a sequence of markets, that is, it is a multimarket enviroment. In the case of the Iberian Energy Market the sequence of major short-term electricity markets are the day-ahead market, the ancillary service market or secondary reserve market (henceforth reserve market), and a set of six intraday markets. Generation Companies (GenCos) that participate in the electricity market could increase their benefits by jointly optimizing their participation in this sequence of electricity markets. This work proposes a stochastic programming model that gives the GenCo the optimal bidding strategy for the day-ahead market (DAM), which considers the benefits and costs of participating in the subsequent markets and which includes both physical futures contracts and bilateral contracts. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Optimización de modelos estocásticos de mercado eléctrico múltiple mediante métodos duales

Wed, 03/30/2011 - 09:47 — admin| Publication Type | Tesis de Grau i Màster // BSc and MSc Thesis |

| Year of Publication | 2011 |

| Authors | Unai Aldasoro Marcellan |

| Director | F. Javier Heredia |

| Tipus de tesi | MSc Thesis |

| Titulació | Màster in Statistics and Operations Research |

| Centre | Facultat de Matemàtiques i Estadística, departament d'Estadística i Investigació Operativa, UPC |

| Data defensa | 16/03/2011 |

| Nota // mark | Matrícula d'Honor (10/10) |

| Key Words | teaching; research; dual methods; electricity markets; DPI2008-02153; mixed integer nonlinear programming; proximal bundle method; optimal day-ahead bid; electricity multimarket; MSc Thesis |

| Abstract | El presente trabajo plantea la resolución computacional de un modelo de optimización de la oferta de generación eléctrica para compañías eléctricas que participan en el mercado eléctrico liberalizado MIBEL. Dicho mercado se circunscribe a España y Portugal y se compone de una serie de subastas energéticas consecutivas donde el operador de mercado realiza para cada una de ellas la casación entre la oferta y demanda. Así, el objetivo de la compañía generadora será maximizar los beneficios obtenidos en la participación del conjunto de mercados teniendo en cuenta el cumplimiento de las obligaciones contractuales ya establecidas. El modelo matemático propuesto para su caracterización corresponde a un modelo de programación estocástica multietapa cuyo equivalente determinista es un problema de optimización cuadrática con variable binaria. Con el objetivo de aprovechar la estructura del problema se procede a plantear la dualización de un grupo de restricciones que producen que el problema original pueda ser dividido en subproblemas. Para su resolución se deberá estudiar la idoneidad de diversos métodos duales (subgradiente, Bundle Methods, ACCPM) y seleccionar el más conveniente para el caso abordado. La decisión finalmente adoptada ha consistido en elegir como método de resolución el algoritmo Proximal Bundle Method descrito en [18] y adaptado satisfactoriamente a problemas de coordinación de la generación hidro-térmica [17]. El análisis de método Proximal Bundle Method corresponderá a su compresión e interpretación gráfica, a la resolución de un ejemplo de pequeña escala de manera analítica y a su resolución computacional. El objetivo de la fase de resolución será valorar el proceso iterativo y la convergencia del Proximal Bundle Method aplicado al problema multimercado de oferta óptima y la comparación de resultados respecto a otro método dual como el método del subgradiente. La implementación computacional se realizará mediante el lenguaje C++, específicamente se utilizará el metalenguaje Concert Techonolgy creado por IBM para el enlace entre el código C++ y el solver CPLEX. Se comprueba que dicho lenguaje tiene como ventajas principales su simplicidad estructural y el compacto código que produce. No obstante la implementación del Proximal Bundle Method manifiesta una serie de limitaciones prácticas de Concert Technology en cuanto al almacenado y actualización de problemas de optimización. Se propone como línea de futuro el análisis de lenguajes alternativos. En todo caso, los resultados obtenidos desprenden que el Proximal Bundle Method se adapta satisfactoriamente al problema multimercado de oferta óptima, además se concluye que en la aplicación numérica considerada un tamaño de Bundle ilimitado produce los mejores resultados. Además en trabajo propone una serie de líneas de investigación futuras en las que destacan la paralelización de la resolución de los subproblemas, y la definición del subproblema asociado a cada térmica como un problema de caminos mínimos |

| DOI / handle | http://hdl.handle.net/2099.1/13917 |

| URL | Click Here |

| Export | Tagged XML BibTex |

Optimal Day-Ahead Bidding in the MIBEL's Multimarket Energy Production System

Wed, 10/27/2010 - 11:07 — admin| Publication Type | Proceedings Article |

| Year of Publication | 2010 |

| Authors | Cristina Corchero; F.-Javier Heredia |

| Conference Name | 7th Conference on European Energy Market EEM10 |

| Series Title | Proceedings of the 7th Conference on European Energy Market EEM10 |

| Volume | 1 |

| Pagination | 1 - 6 |

| Conference Start Date | 23/06/2010 |

| Publisher | IEEE |

| Conference Location | Madrid |

| Editor | IEEE |

| ISBN Number | 978-1-4244-6838-6 |

| Key Words | research; DPI2008-02153; multimarket; MIBEL; stochastic programming; futures contracts; bilateral contracts; optimal bid; paper |

| Abstract | A Generation Company (GenCo) can participate in the Iberian Electricity Market (MIBEL) through different mechanisms and pools: the bilateral contracts, the physical derivatives products at the Derivatives Market, the bids to the Day-Ahead Market, the Intraday Markets or the Ancillary Services Markets. From the short-term generation planning point of view, the most important problem to solve is the bidding strategy for the Day-Ahead Market (DAM) given that the 85% of the physical energy traded in Spain is negotiated in it, but this participation cannot be tackled independently of other subsequent markets. |

| URL | Click Here |

| DOI | 10.1109/EEM.2010.5558714 |

| Export | Tagged XML BibTex |

Optimal day-ahead bidding strategy in the MIBEL's multimarket energy production system

Thu, 07/29/2010 - 12:14 — admin| Publication Type | Report |

| Year of Publication | 2010 |

| Authors | Cristina Corchero; F.-Javier Heredia |

| Pages | 6 |

| Date | 07/2010 |

| Reference | Research report DR 2010/**, Dept. of Statistics and Operations Research. E-Prints UPC, http://hdl.handle.net/2117/8390. Universitat Politècnica de Catalunya |

| Prepared for | Published by the IEEE at the proceedings of the 7th Conference on European Energy Market EEM10, Madrid, Spain |

| Key Words | research; electricity markets; multimarkets; day-ahead market; intraday market; AGC market; stochastic programming |

| Abstract | A Generation Company (GenCo) can participate in the Iberian Electricity Market (MIBEL) through different mechanisms and pools: the bilateral contracts, the physical derivatives products at the Derivatives Market, the bids to the Day-Ahead Market, the Intraday Markets or the Ancillary Services Markets. From the short-term generation planning point of view, the most important problem to solve is the bidding strategy for the Day-Ahead Market (DAM) given that the 85% of the physical energy traded in Spain is negotiated in it, but this participation cannot be tackled independently of other subsequent markets. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Optimal Day-Ahead Bidding in the MIBEL's Multimarket Energy Production System

Mon, 06/28/2010 - 15:17 — admin| Publication Type | Conference Paper |

| Year of Publication | 2010 |

| Authors | Cristina Corchero; F.-Javier Heredia |

| Conference Name | 7th Conference on European Energy Market EEM10 |

| Conference Date | 23-25/06/2010 |

| Conference Location | Madrid, Spain |

| Type of Work | Contributed Presentation |

| Key Words | research; multimarket; bilateral contracts; futures contracts; optimal bid; stochastic programming; MIBEL |

| Abstract | Abstract—A Generation Company (GenCo) can participate in the Iberian Electricity Market (MIBEL) through different mechanisms and pools: the bilateral contracts, the physical derivatives products at the Derivatives Market, the bids to the Day-Ahead Market, the Intraday Markets or the Ancillary Services Markets. From the short-term generation planning point of view, the most important problem to solve is the bidding strategy for the Day-Ahead Market (DAM) given that the 85% of the physical energy traded in Spain is negotiated in it, but this participation cannot be tackled independently of other subsequent markets. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Lectura d'una Tesi Final de Màster a l'FME

Thu, 03/05/2009 - 13:40 — admin

Dimecres 4 de març es va llegir a la Facultat de Matemàtiques i Estadística la Tesi Final de Màster d'Enginyeria Matemàtica de l'alumna Eva Romero i Beneyto, que porta per títol "Oferta òptima multi – mercat al Mercat Ibèric d’Electricitat", i que he tingut el plaer de dirigir. En aquest treball es proposa un nou model, basat en els treball de Plazas et al. i Heredia et al. , per a l'oferta òptima al mercat diari tenint en compte els mercats de secundària i intradiari. Clicant aquí obtindreu més informació .